See what’s trending right now

Hong Kong economyin Financial Markets

an hour agoHong Kong faces financial instability as Grand Ming defaults on a $611M loan, raising doubts about its IPO momentum, while leaders reassure investors of the city's stability.

Financial Markets

Trump sends out tariff letters, extends levy deadline - what's moving markets

neutralFinancial Markets

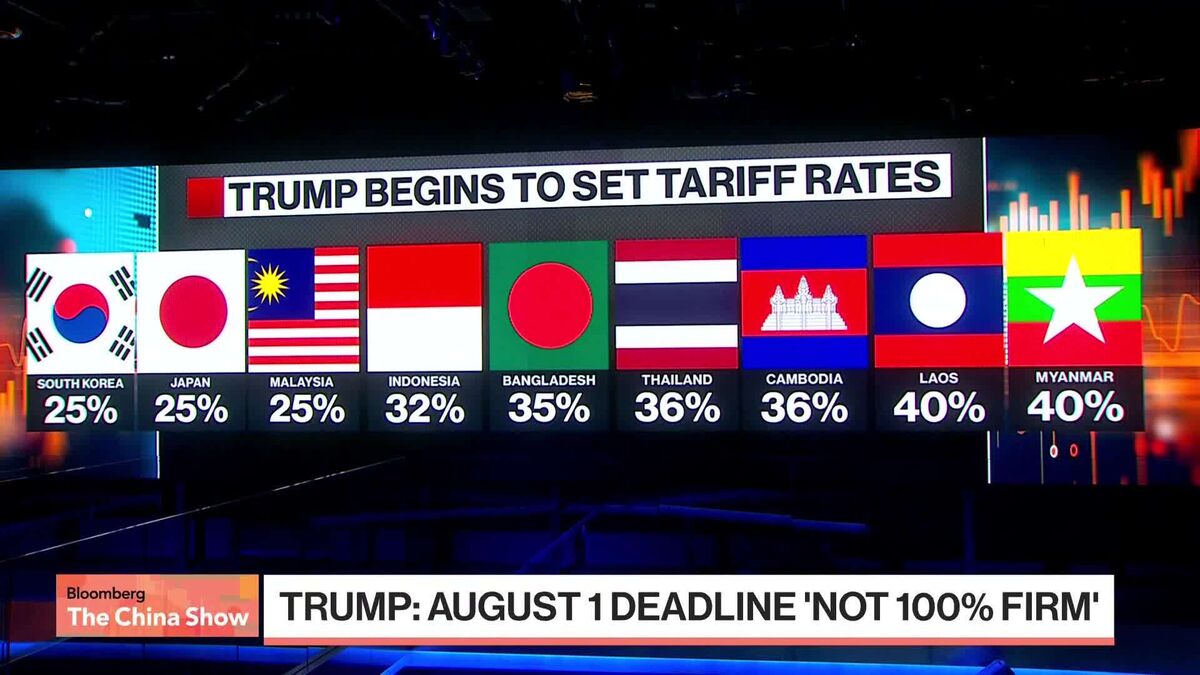

Former President Trump has sent out letters regarding new tariffs and extended the deadline for certain levies, stirring up market reactions. While the details are still emerging, the move signals potential shifts in trade policy that could impact businesses and investors. Markets are watching closely to see how this plays out.

Editor’s Note: Tariffs and trade policies have a direct effect on prices, supply chains, and market stability. Trump’s latest actions—whether seen as aggressive or strategic—could ripple through industries that rely on imports or exports. For everyday consumers, this might mean changes in product costs down the line. Investors, meanwhile, are weighing the risks before making moves. It’s a reminder that political decisions don’t stay in Washington—they hit wallets and portfolios, too.

Southeast Asia, spooked by Trump tariffs, presses for more talks

negativeFinancial Markets

Southeast Asian countries are getting nervous about the potential return of Trump-era tariffs if he wins the U.S. election, and they’re pushing for more dialogue to avoid another trade war. Leaders in the region remember the disruption from his first term and want to get ahead of any new barriers that could hurt their export-driven economies.

Editor’s Note: If Trump returns to the White House, his aggressive trade policies could ripple through global markets—especially in Southeast Asia, which relies heavily on exports to the U.S. Countries like Vietnam and Thailand are already signaling they won’t just sit back and take it, but preemptive talks might not be enough to stop another wave of protectionism. For businesses and consumers, this could mean higher prices and more uncertainty.

South Korea to step up US trade talks before tariffs kick in on August 1

negativeFinancial Markets

South Korea is scrambling to negotiate with the U.S. before new tariffs on its exports take effect August 1. The talks aim to avoid or soften the economic blow, particularly for key industries like steel and autos. It’s a high-stakes diplomatic and economic dance—Seoul wants to protect its trade interests without escalating tensions.

Editor’s Note: Tariffs hurt businesses and consumers on both sides, so these talks aren’t just bureaucratic—they could directly impact jobs, prices, and even the broader U.S.-South Korea alliance. If negotiations fail, expect higher costs for everything from cars to machinery, and possibly some political friction between the two allies.

Bangladesh to Push for Deeper Tariff Cuts in Talks with US

neutralFinancial Markets

Bangladesh isn't backing down—despite the U.S. hitting its exports with a steep 35% tariff, the country plans to double down in negotiations to secure even deeper tariff cuts. It’s a bold move, signaling they’re willing to push harder for better trade terms.

Editor’s Note: Trade tensions between the U.S. and smaller economies like Bangladesh often fly under the radar, but this could set a precedent. If Bangladesh succeeds, it might encourage other developing nations to negotiate more aggressively, reshaping global trade dynamics in subtle but meaningful ways. If it fails, though, it could squeeze an economy that relies heavily on exports. Either way, it’s a high-stakes game of economic chess.

Tariff Price Hikes To Hit US Consumers Soon, Warns Footwear Group

negativeFinancial Markets

The US is gearing up to hit consumers with higher prices on shoes and other goods after President Trump extended tariffs on imports from countries like Malaysia and Indonesia. Matt Priest, head of a major footwear trade group, says the uncertainty is making it tough for shoe companies to plan where to source their products—and warns that shoppers are already feeling the pinch from rising costs.

Editor’s Note: If you’ve noticed your sneakers or boots getting pricier, this is part of why. Tariffs often end up costing everyday shoppers more, and with no clear end in sight, companies (and your wallet) are stuck in limbo. It’s another ripple effect of the ongoing trade tensions—one that hits close to home when you’re shopping for basics.

Stuurman: Trump's Tariffs Impact Won’t Be Easily Undone

negativeFinancial Markets

President Trump’s looming tariffs are creating uncertainty across Africa, as no African nation has yet secured a trade deal with the U.S. to mitigate the potential fallout. Ziyanda Stuurman, an advisor at Africa Practice, broke it down in a Bloomberg interview, explaining that even if these tariffs are rolled back later, their ripple effects—like disrupted supply chains and strained economic relationships—won’t just vanish overnight.

Editor’s Note: This isn’t just about tariffs—it’s about the long-term economic hangover they could leave behind. African economies, already navigating complex global trade dynamics, might face lasting disruptions even if the policies change. For businesses and governments, the uncertainty alone is a problem, making it harder to plan and invest. It’s a reminder that trade wars aren’t just headlines; they have real, sticky consequences.

Your Tariffs Are in the Mail, Sealed With a Diss

negativeFinancial Markets

The article highlights ongoing trade tensions, noting that some countries are still waiting to receive formal tariff notifications—and the tone of these letters is far from friendly. It suggests that the drama isn't over yet for global trading partners.

Editor’s Note: This isn’t just bureaucratic paperwork—it’s a sign that trade disputes are still simmering. For businesses and economies tied to these partnerships, unresolved tensions could mean more uncertainty, higher costs, or even retaliatory measures down the line. In short: buckle up, because the trade wars aren’t done causing headaches.

Tariffs Becoming Broader Tool, HSBC's Neumann Says

neutralFinancial Markets

HSBC economist Frederic Neumann points out that financial markets seem unfazed by President Trump’s decision to extend the trade talks deadline, but he flags a bigger shift—tariffs are no longer just about fixing trade imbalances. They’re being used more broadly, almost like a Swiss Army knife for policy goals beyond simple economics.

Editor’s Note: This isn’t just about trade wars anymore. If tariffs are morphing into a multipurpose tool—say, for political leverage or strategic rivalry—it could signal a lasting change in how global economies interact. Investors might shrug now, but businesses and governments should watch closely. The rules of the game could be shifting underfoot.

Trump Issues New Tariff Rates, Says US Still Open to Talks

neutralFinancial Markets

President Trump has announced new tariff rates targeting major US trading partners, marking the start of a series of planned hikes. However, he left the door open for further negotiations and delayed the increased duties until August 1, signaling a possible willingness to avoid an immediate trade war.

Editor’s Note: This move keeps tensions high in global trade but also buys time for talks—essentially a "threat with a pause button." For businesses and consumers, it means uncertainty lingers over whether prices will rise or if deals can be struck before the new tariffs kick in. It’s a high-stakes game of economic chicken.

Why World Pulse Now?

Global Coverage

All major sources, one page

Emotional Lens

Feel the mood behind headlines

Trending Topics

Know what’s trending, globally

Read Less, Know More

Get summaries. Save time

Stay informed, save time

Learn moreLive Stats

Articles Processed

7,540

Trending Topics

168

Sources Monitored

211

Last Updated

an hour ago

Live data processing

How it works1-Minute Daily Briefing

Stay sharp in 60 seconds. Get concise summaries of today’s biggest stories — markets, tech, sports, and more

Why World Pulse Now?

Global Coverage

All major sources, one page

Emotional Lens

Feel the mood behind headlines

Trending Topics

Know what’s trending, globally

Read Less, Know More

Get summaries. Save time

Stay informed, save time

Learn moreLive Stats

Articles Processed

7,540

Trending Topics

168

Sources Monitored

211

Last Updated

an hour ago

Live data processing

How it works1-Minute Daily Briefing

Stay sharp in 60 seconds. Get concise summaries of today’s biggest stories — markets, tech, sports, and more