See what’s trending right now

Asian tradein Financial Markets

5 hours agoChina's credit demand surges with June yuan loans exceeding forecasts, supported by seasonal factors and bond sales, while Synopsys gains conditional approval to acquire Ansys, signaling regulatory openness.

Show me

Financial Markets

China's June new yuan loans beat forecast after stimulus and trade truce

PositiveFinancial Markets

China's new yuan loans in June came in higher than expected, showing a boost from recent government stimulus measures and a temporary easing of trade tensions. This suggests businesses and consumers might be a bit more confident, at least for now.

Editor’s Note: When China's lending numbers go up, it’s often a sign that policymakers are trying to keep growth on track—especially when trade disputes or slower demand threaten to drag things down. This uptick hints that recent efforts to juice the economy might be working, at least in the short term. For global markets, it’s a small but welcome signal that China isn’t slowing down as sharply as some feared.

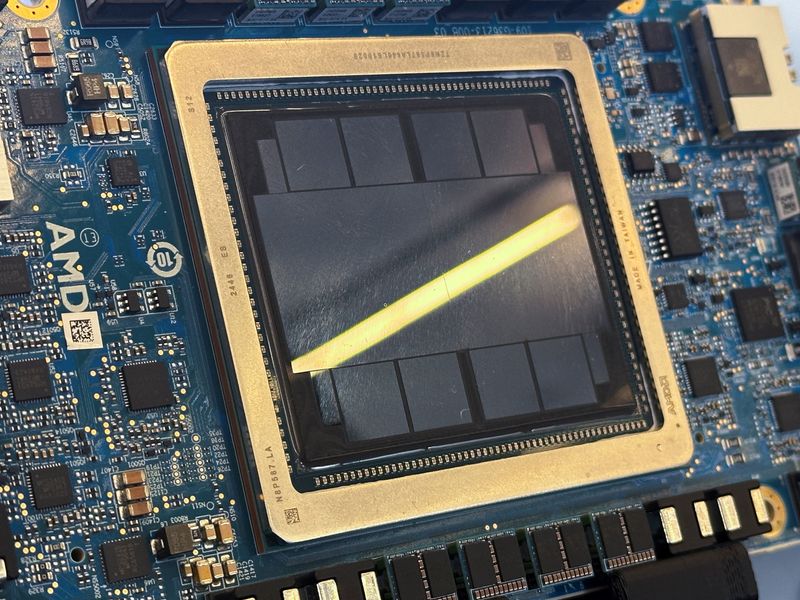

China gives conditional nod to Synopsys-Ansys deal, removing last major hurdle

NeutralFinancial Markets

China has approved the $35 billion acquisition of engineering software firm Ansys by chip design giant Synopsys—but with some conditions attached. This green light was the final major regulatory hurdle for the deal, which had already gotten nods from the U.S. and EU. While the exact conditions aren’t spelled out, it’s a sign that China’s willing to let big tech mergers proceed as long as they don’t threaten domestic competition.

Editor’s Note: This deal is a big deal (pun intended) because Synopsys and Ansys are heavyweights in semiconductor and simulation software—tools that underpin everything from smartphones to AI. China’s conditional approval suggests it’s balancing openness to global tech deals with protecting its own industry. For the broader market, it signals that even amid U.S.-China tensions, billion-dollar tech tie-ups can still clear hurdles—just with extra fine print.

China Credit Growth Tops Forecasts on Seasonal Boost, Bond Sales

NeutralFinancial Markets

China's credit growth surged past expectations in June, thanks to a seasonal uptick in lending and a wave of government bond sales. It's a sign that policymakers might be stepping up efforts to juice the economy, but the question is whether this is just a temporary bump or the start of a sustained push.

Editor’s Note: Credit growth is like the economy's pulse—when it picks up, it usually means more money flowing into businesses and households. This could signal China's trying to combat sluggish growth, but seasonal factors make it tricky to tell if this is a real turnaround or just a blip. Investors and analysts will be watching closely to see if this momentum holds.

China’s exports grew at a faster clip in June, topping market expectations as trade tensions with the U.S. eased following a round of bilateral talks

PositiveFinancial Markets

China's export numbers surprised analysts by growing faster than expected in June, signaling a potential rebound in global trade. While shipments to the U.S. still dropped, the decline wasn’t as steep as in previous months—a sign that recent talks between the two economic giants may be easing some of the tension.

Editor’s Note: This isn’t just about spreadsheets and percentages—it’s a real-world indicator that things might be thawing between China and the U.S. after months of strained trade relations. Stronger exports could mean more stability for businesses and workers tied to global supply chains, though the lingering drop in U.S. shipments shows there’s still work ahead. If this trend holds, it could ease some of the pressure on both economies.

Thailand considering offering zero tariffs on more U.S. imports, finance minister says

NeutralFinancial Markets

Thailand’s finance minister has floated the idea of slashing tariffs on additional U.S. imports to zero, signaling a potential thaw in trade relations between the two countries. This could mean cheaper American goods for Thai consumers and a boost for U.S. exporters—but it’s still just talk for now.

Editor’s Note: Trade deals might not sound thrilling, but this could be a big deal for businesses and shoppers in both countries. If Thailand follows through, it’d mark a shift toward friendlier economic ties with the U.S., possibly counterbalancing China’s influence in the region. For now, though, it’s a wait-and-see game.

China's yuan-denominated exports in June rise 7.2% y/y, imports grow 2.3%

PositiveFinancial Markets

China's trade data for June shows a solid uptick in exports, which grew by 7.2% compared to last year when measured in yuan. Imports also climbed, though more modestly, at 2.3%. This suggests global demand for Chinese goods remains steady, while domestic consumption is ticking up—just not as sharply.

Editor’s Note: This isn’t just a dry stats update—it’s a pulse check on China’s economic health. Stronger exports mean factories are humming and global buyers still rely on Chinese products, even amid trade tensions. The slower import growth hints that local demand isn’t roaring back yet, but it’s moving in the right direction. For markets, it’s a sign that China’s recovery isn’t stalling (yet).

China June rare earth exports at 7,742.2 tonnes

NeutralFinancial Markets

China exported 7,742.2 tonnes of rare earth minerals in June, according to the latest data. While the exact figures fluctuate month to month, this gives us a snapshot of China's ongoing dominance in supplying these critical materials used in everything from smartphones to electric vehicles.

Editor’s Note: Rare earths are the unsung heroes of modern tech, and China controls a huge chunk of the global supply. This export number isn’t just a dry stat—it’s a pulse check on how much of these vital resources are flowing out to the world. If exports dip or surge, it could signal shifts in trade policies, global demand, or even geopolitical tensions over supply chains. For industries reliant on these materials, that’s a big deal.

Malaysia says trade permit required for AI chips of U.S. origin

NeutralFinancial Markets

Malaysia has announced that any AI chips originating from the U.S. will now require a special trade permit before they can be imported. This move adds a layer of bureaucracy for tech companies relying on these components, potentially slowing down supply chains or increasing costs.

Editor’s Note: This isn’t just red tape—it’s a sign of how governments are tightening control over critical tech, especially AI hardware. For businesses, it could mean delays or higher expenses, but for Malaysia, it’s likely about managing supply chains or even geopolitical balancing. Either way, it’s another ripple in the global tech trade landscape.

South Korea says framework US trade deal possible by August, farm market access on table

NeutralFinancial Markets

South Korea and the U.S. are inching closer to a revised trade deal, with officials hinting that a broad framework could be finalized by August. Interestingly, Seoul is open to discussing better access for American agricultural products—a sticking point in past negotiations.

Editor’s Note: Trade talks between allies aren’t always smooth, but this signals progress. If finalized, the deal could ease tensions over market access, especially for U.S. farmers who’ve pushed for fewer restrictions. For South Korea, it’s a balancing act—protecting domestic agriculture while keeping a key economic partnership strong.

Why World Pulse Now?

Global Coverage

All major sources, one page

Emotional Lens

Feel the mood behind headlines

Trending Topics

Know what’s trending, globally

Read Less, Know More

Get summaries. Save time

Stay informed, save time

Learn moreLive Stats

Articles Processed

7,751

Trending Topics

116

Sources Monitored

204

Last Updated

30 minutes ago

Live data processing

How it works1-Minute Daily Briefing

Stay sharp in 60 seconds. Get concise summaries of today’s biggest stories — markets, tech, sports, and more

Why World Pulse Now?

Global Coverage

All major sources, one page

Emotional Lens

Feel the mood behind headlines

Trending Topics

Know what’s trending, globally

Read Less, Know More

Get summaries. Save time

Stay informed, save time

Learn moreLive Stats

Articles Processed

7,751

Trending Topics

116

Sources Monitored

204

Last Updated

30 minutes ago

Live data processing

How it works1-Minute Daily Briefing

Stay sharp in 60 seconds. Get concise summaries of today’s biggest stories — markets, tech, sports, and more