See what’s trending right now

Hong Kong economyin Financial Markets

4 hours agoHong Kong faces financial instability as Grand Ming defaults on a $611M loan, raising doubts about its IPO momentum, while leaders reassure investors of the city's stability.

Financial Markets

Hong Kong developer Grand Ming’s crisis deepens with US$611 million loan default

negativeFinancial Markets

Hong Kong's Grand Ming Group is in serious financial trouble, admitting it still hasn't paid back a massive $611 million loan. The company's debt levels have skyrocketed past 200% of its equity, and it's violated key terms of its borrowing agreements. This isn't just about one struggling developer—it's part of a worrying pattern of smaller Hong Kong real estate firms buckling under debt pressures.

Editor’s Note: When property developers start defaulting on loans this big, it sends shockwaves through the economy. Hong Kong's real estate market has long been a pillar of stability, but cracks are showing—especially for smaller players. This could mean tighter lending, stalled projects, and even job losses if the dominoes start falling. Keep an eye on whether this stays contained or starts affecting bigger names.

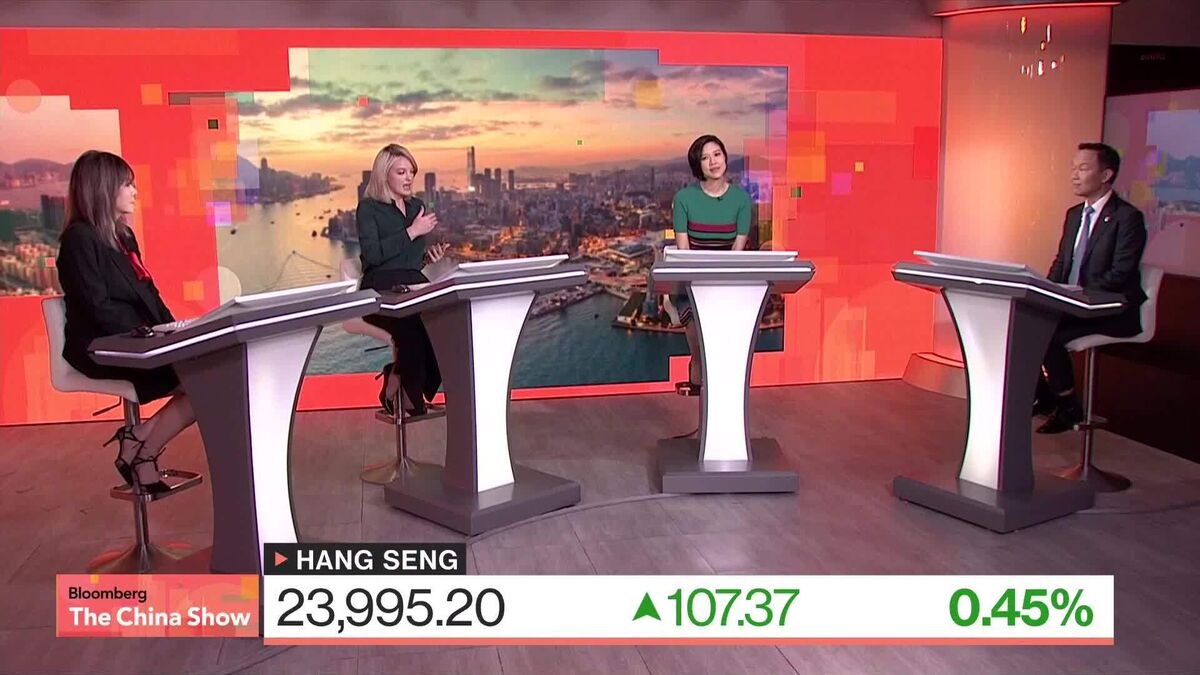

Is HK's IPO Momentum Sustainable?

neutralFinancial Markets

Hong Kong's IPO market is heating up this year, fueled by Chinese companies looking for new funding and global investors shifting focus from the U.S. due to geopolitical tensions. Top executives from HKEx and JPMorgan—Johnson Chui and Nelly Pai—discuss what’s driving the surge and whether this momentum can last through the rest of 2024.

Editor’s Note: Hong Kong’s IPO boom is a big deal because it signals where money is flowing in uncertain times. If Chinese firms keep choosing HK over the U.S., it could reshape global capital markets—but the question is whether this is just a short-term trend or a lasting shift. Investors and businesses will be watching closely.

Hong Kong leaders say city is good place for investors to seek stability

neutralFinancial Markets

Hong Kong officials are pitching the city as a safe haven for investors looking to dodge global instability. Alpha Lau Hai-suen from InvestHK—the agency responsible for attracting foreign money—admitted that post-pandemic investment hasn’t fully bounced back, blaming trade wars and tariffs. But the message is clear: Hong Kong wants to position itself as the steady hand in a shaky world.

Editor’s Note: With global markets on edge—thanks to trade tensions, inflation, and geopolitical drama—Hong Kong’s leaders are trying to reassure investors that the city is a reliable bet. It’s a tough sell after years of political unrest and pandemic disruptions, but if businesses buy into the stability argument, it could help revive Hong Kong’s financial mojo. Worth watching, especially for anyone tracking Asia’s economic hubs.

China expands Bond Connect as more players join banks in offshore market

positiveFinancial Markets

China is opening up its Bond Connect program to more mainland financial players—like securities firms, fund managers, and insurers—letting them invest in offshore bonds through Hong Kong. This move loosens capital controls and strengthens Hong Kong’s role as a global finance hub.

Editor’s Note: This isn’t just about more investors getting access—it’s a signal China’s easing its grip on capital flows, which could mean bigger opportunities for global markets. For Hong Kong, it’s a win, reinforcing its position as a key financial bridge between China and the world. If you’re watching Asia’s financial landscape, this is a step worth noting.

Shein files for confidential IPO in Hong Kong after UK setbacks - report

neutralFinancial Markets

Fast-fashion giant Shein is reportedly planning a confidential IPO in Hong Kong after facing regulatory hurdles in the UK. The move suggests a pivot to Asian markets amid growing scrutiny over its business practices in the West.

Editor’s Note: Shein's IPO plans are a big deal because they signal how the company is adapting to global pressures. After backlash over sustainability and labor concerns derailed its UK ambitions, Hong Kong offers a friendlier regulatory environment—but it also raises questions about whether Shein can win back investor confidence. For shoppers and markets alike, this could reshape the future of ultra-fast fashion.

Hong Kong stocks snap 3-day decline on optimism about US trade deals

positiveFinancial Markets

Hong Kong stocks bounced back after three straight days of losses, fueled by hopes that the US might ease up on trade tensions. The Trump administration’s decision to delay new tariffs on several countries gave investors a reason to cheer, pushing the Hang Seng Index up nearly 1%. Tech stocks and mainland Chinese markets also saw gains, suggesting a broader sigh of relief across regional markets.

Editor’s Note: Trade tensions between the US and its partners have been a major headache for global markets, so any sign of softening—even a temporary delay—can spark optimism. For Hong Kong, which is deeply tied to global trade flows, this could mean a bit of breathing room after recent declines. But don’t pop the champagne yet—tariff talks are notoriously unpredictable, and today’s rally might just be a short-term reaction.

HSBC, Manulife, BOC Life expand offerings for Hong Kong retirees

positiveFinancial Markets

Big financial players like HSBC, Manulife, and BOC Life are rolling out new investment options specifically designed for Hong Kong retirees, offering regular payouts (like HSBC’s new funds aiming for 6% annual dividends). This is part of a bigger push to tap into the "silver economy" as the city’s aging population grows.

Editor’s Note: With more Hong Kongers entering retirement, these products could help seniors stretch their savings—but it’s also a sign banks are scrambling to profit from a demographic shift. Whether these returns hold up (they’re "non-guaranteed," after all) is the real question for retirees banking on that income.

Hong Kong economy’s ‘mixed signals’ portend retail ‘turbulence’, analysts say

neutralFinancial Markets

Hong Kong's retail sector is in for a bumpy ride, with analysts pointing to conflicting trends—rising unemployment could hurt local spending, but a rebound in tourism and household incomes might offset some of the pain. Property consultancy CBRE describes it as a "mixed signals" situation, where store closures continue even as other signs suggest recovery.

Editor’s Note: This isn't just another "doom or boom" story—it's a real-time snapshot of an economy caught between competing forces. For locals, job worries might tighten wallets, but the return of tourists could keep cash registers ringing in certain sectors. It’s a reminder that economic recoveries aren’t always smooth, especially in global hubs like Hong Kong where outside factors (like tourism) play a huge role. Businesses will need to stay nimble to navigate the turbulence.

Why World Pulse Now?

Global Coverage

All major sources, one page

Emotional Lens

Feel the mood behind headlines

Trending Topics

Know what’s trending, globally

Read Less, Know More

Get summaries. Save time

Stay informed, save time

Learn moreLive Stats

Articles Processed

7,806

Trending Topics

168

Sources Monitored

211

Last Updated

13 minutes ago

Live data processing

How it works1-Minute Daily Briefing

Stay sharp in 60 seconds. Get concise summaries of today’s biggest stories — markets, tech, sports, and more

Why World Pulse Now?

Global Coverage

All major sources, one page

Emotional Lens

Feel the mood behind headlines

Trending Topics

Know what’s trending, globally

Read Less, Know More

Get summaries. Save time

Stay informed, save time

Learn moreLive Stats

Articles Processed

7,806

Trending Topics

168

Sources Monitored

211

Last Updated

13 minutes ago

Live data processing

How it works1-Minute Daily Briefing

Stay sharp in 60 seconds. Get concise summaries of today’s biggest stories — markets, tech, sports, and more