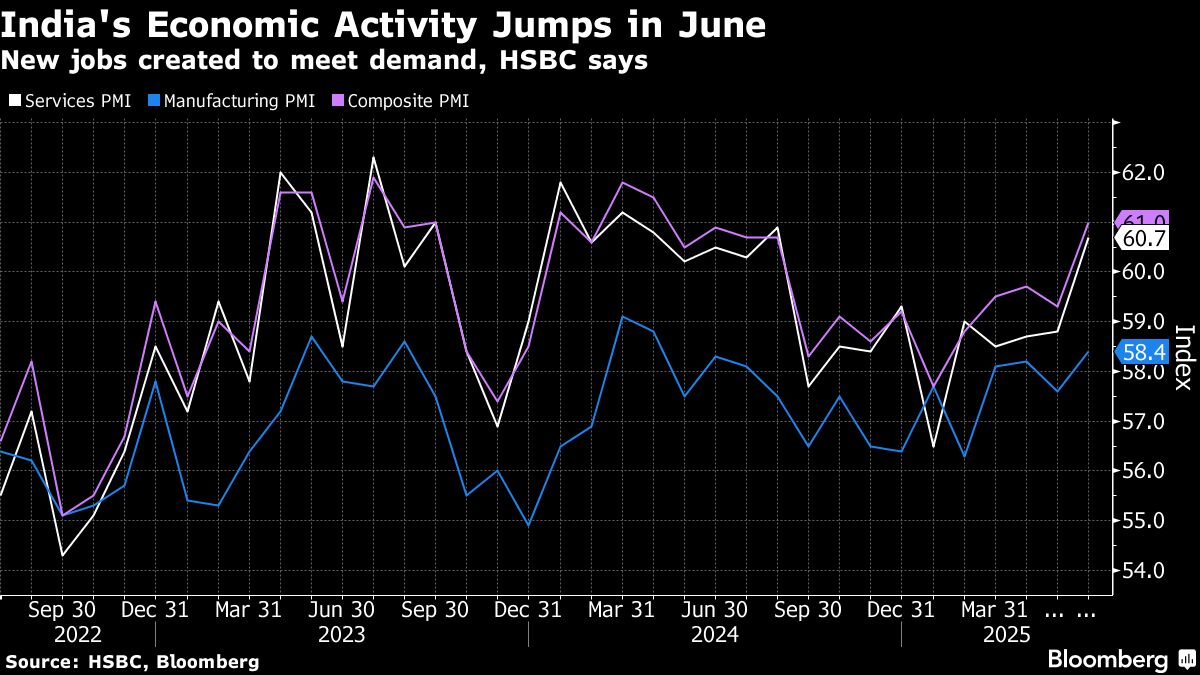

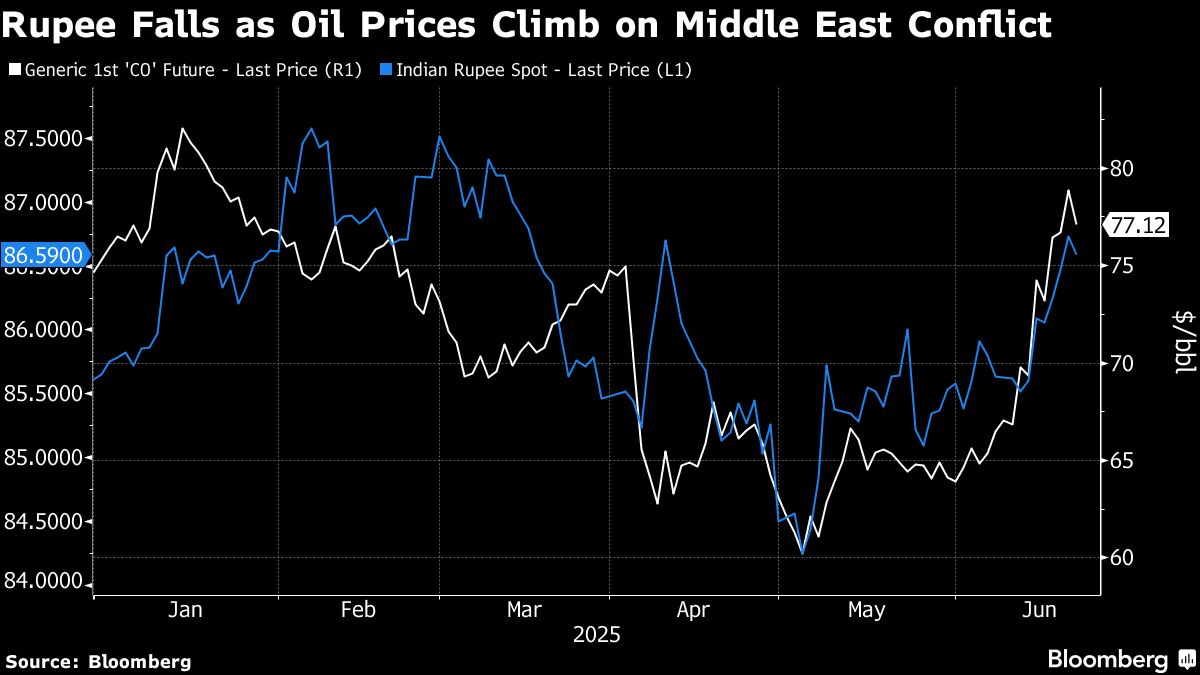

India's private sector and business activity surge in June due to strong demand and record exports, while KKR weighs a counterbid for Spectris amid Advent's offer, signaling robust economic momentum and competitive dealmaking.

Why World Pulse Now?

Global Coverage

All major sources, one page

Emotional Lens

Feel the mood behind headlines

Trending Topics

Know what’s trending, globally

Read Less, Know More

Get summaries. Save time

Live Stats

7,432

120

211

an hour ago

Mobile App

Get instant summaries, explore trending stories, and dive deeper into the headlines — all in one sleek, noise-free mobile experience.

1-Minute Daily Briefing

Stay sharp in 60 seconds. Get concise summaries of today’s biggest stories — markets, tech, sports, and more

Why World Pulse Now?

Global Coverage

All major sources, one page

Emotional Lens

Feel the mood behind headlines

Trending Topics

Know what’s trending, globally

Read Less, Know More

Get summaries. Save time

Live Stats

7,432

120

211

an hour ago

Mobile App

Get instant summaries, explore trending stories, and dive deeper into the headlines — all in one sleek, noise-free mobile experience.

1-Minute Daily Briefing

Stay sharp in 60 seconds. Get concise summaries of today’s biggest stories — markets, tech, sports, and more