See what’s trending right now

India marketsin Financial Markets

4 hours agoAdani Power expands with a major acquisition, boosting capacity, while India navigates cautious optimism in US trade talks amid potential pressures. Jane Street's success underscores India's unique market opportunities.

Financial Markets

Adani Power acquires VIPL for Rs 4,000 crore; capacity hits 18,150 MW

positiveFinancial Markets

Adani Power just snapped up Vidarbha Industries Power for a hefty ₹4,000 crore, pushing its total electricity generation capacity to 18,150 MW—that’s enough to power millions of homes. The company isn’t stopping there: it’s aiming to nearly double that capacity by 2030, with plans for both new projects and expansions. This deal is part of Adani’s broader playbook to revive struggling energy assets and tighten its grip on India’s power sector.

Editor’s Note: Big moves in India’s energy landscape—Adani’s aggressive expansion signals confidence in growing power demand, but it also raises questions about market concentration. For consumers, this could mean more stable supply (or higher bills, depending on how pricing shakes out). For investors, it’s a bold bet on infrastructure growth. Either way, it’s a reminder that energy giants are racing to fuel India’s future.

India-US trade deal soon? Donald Trump says so, but India needs to be wary of ‘escalating pressure’; 'in future US may...'

neutralFinancial Markets

Looks like India and the US might be inching closer to a trade deal—Donald Trump says so, at least. But here’s the catch: India’s been given until August 1 to wrap things up, and experts are warning that even if a deal happens, it might not stop the US from slapping sudden tariffs on Indian exports later. So, while there’s progress, India’s walking a tightrope between securing an agreement and avoiding future pressure.

Editor’s Note: Trade deals are tricky, especially with the US under Trump’s "America First" playbook. For India, locking in an agreement could mean smoother exports now, but there’s no guarantee against future trade spats. It’s a reminder that in global trade, today’s handshake doesn’t always mean tomorrow’s security.

Jane Street’s Lucrative India Trade Highlights Key Market Quirk

neutralFinancial Markets

Jane Street Group, a major trading firm, raked in billions from a strategy that exploited a unique quirk in India's financial markets—something that wouldn't have been nearly as profitable elsewhere. The article suggests India's market structure played a key role in their success.

Editor’s Note: This isn't just about a big payday for Jane Street—it's a reminder of how local market quirks can create golden opportunities for savvy traders. For investors, it underscores the importance of understanding regional nuances, not just global trends. And for regulators? Maybe a heads-up to check if those quirks need fixing.

Bharat Bandh on July 9, 2025: Are banks and stock markets open or closed tomorrow? Check details of strike

negativeFinancial Markets

A massive nationwide strike called "Bharat Bandh" is set to disrupt normal life on July 9, 2025, as trade unions and farm groups protest government policies they claim favor big businesses at the expense of workers. With an estimated 250 million participants, the strike could shut down banks, transport, and other services—leaving many Indians scrambling to check what’s open or closed.

Editor’s Note: This isn’t just another strike—it’s a huge, coordinated pushback against economic policies affecting millions of workers and farmers. If you’ve got banking or travel plans, you’ll want to stay updated, because this could throw a wrench in your day. Beyond the inconvenience, it’s a sign of growing tension between the government and labor groups, with real stakes for India’s economy.

Stock market today: Nifty50 opens in red; BSE Sensex near 83,400

negativeFinancial Markets

Indian stock markets got off to a shaky start today, with both the Nifty50 and BSE Sensex dipping into the red. The Sensex hovered around 83,400 points as investors reacted to jitters over global trade tensions—specifically, concerns about Donald Trump’s latest tariff moves and unresolved trade deals.

Editor’s Note: For anyone with skin in the game—whether you're an investor, trader, or just keeping an eye on your retirement fund—this dip signals broader unease. Trade wars and policy unpredictability can ripple through markets, affecting everything from big portfolios to everyday consumer prices. It’s a reminder that global politics and economics are tightly tangled, even in local markets.

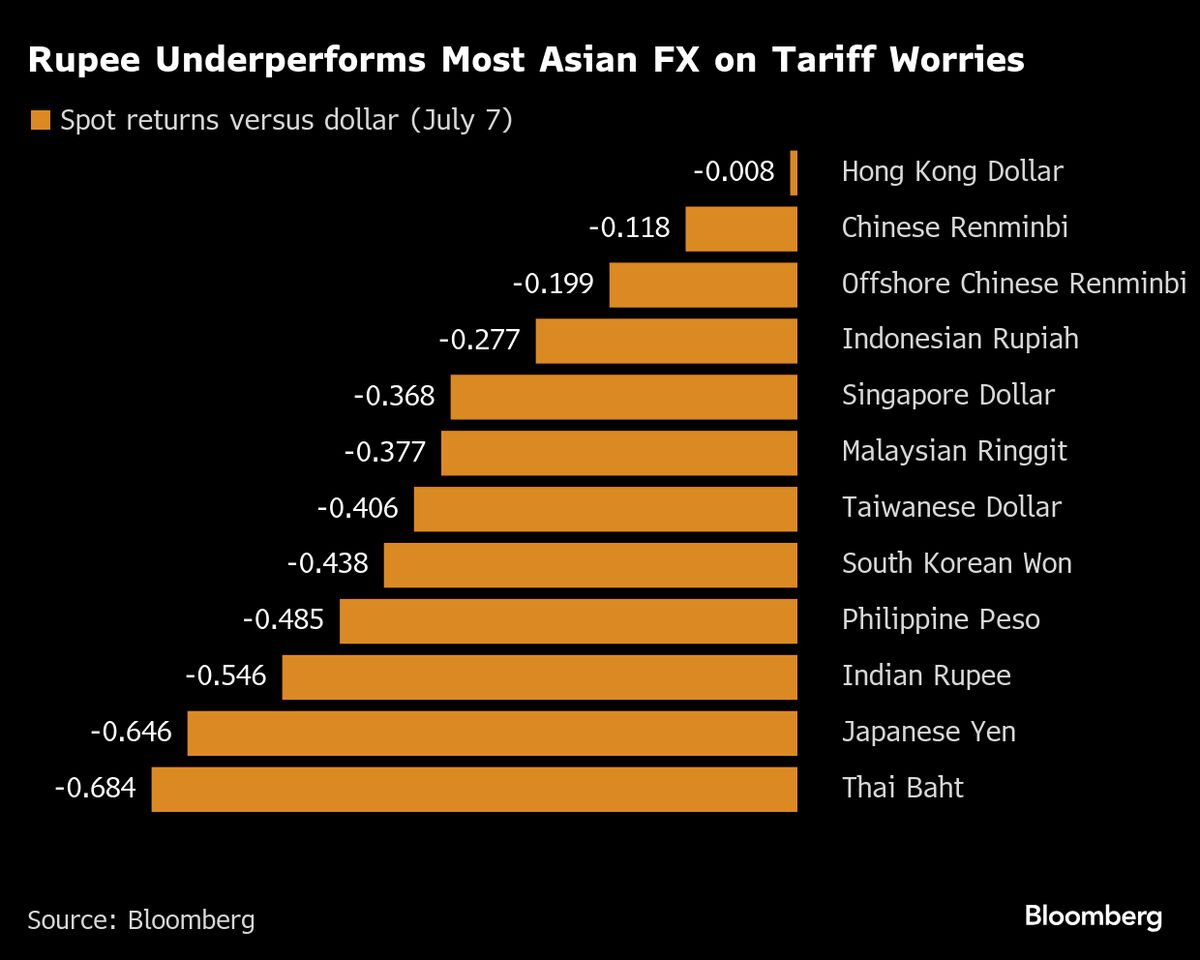

Indian Rupee Underperforms Most Emerging Asian Currencies on Tariff Worries

negativeFinancial Markets

The Indian rupee is lagging behind most other emerging Asian currencies today, as investors grow jittery about potential new tariffs. Market watchers are keeping a close eye on trade tensions, which could spell more volatility for the rupee in the near term.

Editor’s Note: If you're tracking investments in Asia or doing business involving the rupee, this dip—and the uncertainty behind it—could affect everything from import costs to foreign exchange strategies. Trade policies have a way of rippling through economies, and right now, the rupee is feeling the squeeze.

Indian Gift City Exchange Set for First Foreign-Currency Listing

positiveFinancial Markets

India’s NSE International Exchange, based in Gujarat’s Gift City, is gearing up for its first-ever foreign-currency equity listing this quarter. If successful, this move could open up fresh fundraising options for companies looking to tap into global capital without leaving India’s financial hub.

Editor’s Note: This isn’t just another listing—it’s a test of whether India’s Gift City can truly compete with global financial centers like Singapore or Dubai. If companies start using it to raise funds in dollars or euros, it could signal a big step in India’s push to become a more attractive destination for international investors. For businesses, it might mean easier access to foreign capital without the usual regulatory headaches. Keep an eye on this one.

Retail F&O traders lose Rs 1.1 lakh crore in FY25, 41% rise

negativeFinancial Markets

Indian retail traders took a massive hit in the stock market’s futures and options (F&O) segment last fiscal year, losing a staggering ₹1.1 lakh crore—a 41% jump from the year before. Even though trading volumes dipped slightly after SEBI tightened rules, a shocking 91% of retail investors still ended up in the red.

Editor’s Note: This isn’t just another market stat—it’s a wake-up call. F&O trading is often glamorized as a fast track to wealth, but these numbers show how brutally risky it is for everyday investors. With nearly everyone losing money, it raises questions about whether retail traders truly understand these complex instruments or if more safeguards are needed. If you’ve ever been tempted by the "get rich quick" hype around derivatives, this story might make you think twice.

Fund Managers Bet on Bank, Consumer Stocks After India Rate Cuts

positiveFinancial Markets

Big investors are doubling down on Indian bank and consumer stocks, expecting them to keep climbing thanks to recent interest rate cuts by the country’s central bank. They’re betting these sectors will ride the wave of cheaper borrowing costs and stronger economic growth.

Editor’s Note: When central banks cut rates, it usually means cheaper loans and more spending—great news for banks and companies selling everyday goods. If fund managers are piling into these stocks, it signals confidence in India’s economy picking up steam. For everyday investors, it’s a hint where the smart money’s flowing.

Why World Pulse Now?

Global Coverage

All major sources, one page

Emotional Lens

Feel the mood behind headlines

Trending Topics

Know what’s trending, globally

Read Less, Know More

Get summaries. Save time

Stay informed, save time

Learn moreLive Stats

Articles Processed

7,540

Trending Topics

168

Sources Monitored

211

Last Updated

3 hours ago

Live data processing

How it works1-Minute Daily Briefing

Stay sharp in 60 seconds. Get concise summaries of today’s biggest stories — markets, tech, sports, and more

Why World Pulse Now?

Global Coverage

All major sources, one page

Emotional Lens

Feel the mood behind headlines

Trending Topics

Know what’s trending, globally

Read Less, Know More

Get summaries. Save time

Stay informed, save time

Learn moreLive Stats

Articles Processed

7,540

Trending Topics

168

Sources Monitored

211

Last Updated

3 hours ago

Live data processing

How it works1-Minute Daily Briefing

Stay sharp in 60 seconds. Get concise summaries of today’s biggest stories — markets, tech, sports, and more