See what’s trending right now

Japan Inflationin Financial Markets

5 hours agoGlobal markets show resilience with steady shares and a strong US consumer, while the yen weakens ahead of Japan's election and bonds rally amid political uncertainty.

Show me

Financial Markets

Global shares firm as US consumer holds up, yen weak ahead of Japan vote

NeutralFinancial Markets

Global stock markets are holding steady, thanks to resilient U.S. consumer spending—a sign that the economy might avoid a sharper slowdown. Meanwhile, the Japanese yen is sliding as investors brace for a key political decision in Japan, which could shake up currency markets.

Editor’s Note: This isn’t just about numbers on a screen—it’s a snapshot of how everyday spending (yes, your Target runs and coffee habits) is propping up confidence in markets. And the yen’s slump? That could mean ripple effects for trade, travel, and even your next sushi dinner’s price tag. Markets are reading the tea leaves on both sides of the Pacific.

Dollar drops but maintains modest weekly gains

NeutralFinancial Markets

The US dollar dipped slightly in recent trading but still managed to hold onto small gains for the week. It’s a mixed picture—while the greenback lost some ground day-to-day, it’s still ending the week stronger than it started.

Editor’s Note: Currency fluctuations might seem like financial jargon, but they ripple through everything from travel costs to import prices. A wobbly dollar can signal shifting investor confidence or global economic trends—so even small moves are worth watching, especially if you’re planning an overseas trip or running a business that deals with international suppliers.

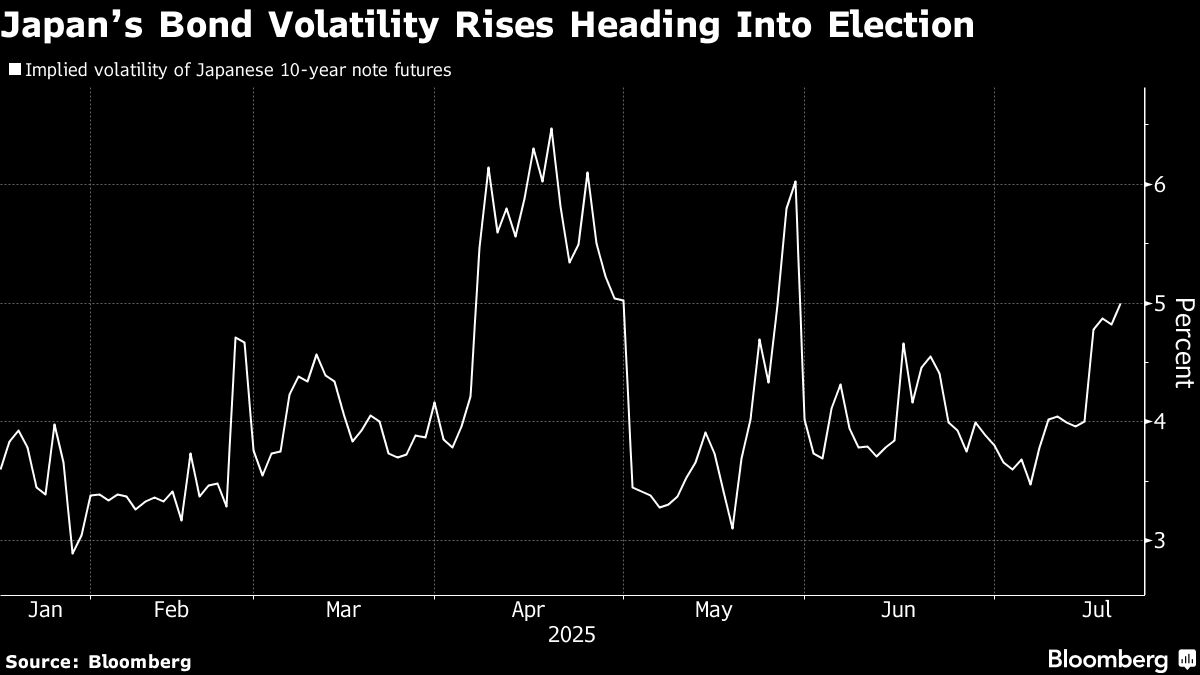

Japanese Bonds Rally as Traders Navigate Uncertain Election

NeutralFinancial Markets

Japanese government bond prices climbed on Friday, pushing yields lower, as investors played it safe ahead of a high-stakes upper house election this weekend. Traders seem to be hedging their bets, opting for the relative stability of bonds amid political uncertainty.

Editor’s Note: Elections can shake up markets, and Japan’s upcoming vote has traders on edge. When investors get nervous, they often flock to government bonds, which are seen as a safer bet. This rally suggests that market players are bracing for potential surprises—whether in policy shifts or political turbulence—once the results roll in. If the election outcome brings clarity, we could see a quick reversal in bond demand. For now, it’s a classic "wait-and-see" moment for Japan’s economy.

German producer prices fall 1.3% y/y in June

NeutralFinancial Markets

Germany's producer prices—what manufacturers charge for goods—dropped 1.3% in June compared to last year, marking the ninth straight month of decline. It’s the sharpest fall since late 2022, driven mostly by cheaper energy costs. While this could ease some inflation pressure for consumers, it also hints at weaker demand in Europe’s biggest economy.

Editor’s Note: Falling producer prices might sound like good news (cheaper stuff, right?), but it’s a mixed bag. Lower energy costs help households and businesses, but the sustained drop suggests factories aren’t charging as much because buyers aren’t rushing to spend. For an economy like Germany’s, which leans heavily on manufacturing, that’s a red flag about sluggish growth ahead.

Japan's markets brace for election impact on JGBs, yen

NeutralFinancial Markets

Japan’s financial markets are on edge as the upcoming election could shake things up for government bonds (JGBs) and the yen. Investors are watching closely to see how political shifts might influence economic policies—especially since Japan’s debt and currency are already under pressure.

Editor’s Note: Elections always bring uncertainty, but in Japan’s case, the stakes are high for its already fragile economy. If new leadership hints at big policy changes—like tweaking the Bank of Japan’s ultra-loose monetary stance—it could send shockwaves through global markets. For everyday folks, this might mean swings in everything from mortgage rates to import prices.

Asia stocks rise; Japan lags on sticky inflation, TSMC brings some cheer

NeutralFinancial Markets

Asian stocks mostly climbed today, but Japan's market struggled as stubborn inflation kept investors cautious. Meanwhile, Taiwan's TSMC gave the region a boost with some upbeat news, balancing out the mixed performance.

Editor’s Note: Inflation’s still a headache for Japan, but strong tech players like TSMC are helping keep Asia’s markets afloat. It’s a reminder that even when some parts of the economy sputter, others can pick up the slack—something traders are watching closely as global uncertainty lingers.

Japan Inflation Eases, But BOJ Still Faces Policy Challenges

NeutralFinancial Markets

Japan’s inflation rate dipped slightly, giving the Bank of Japan (BOJ) a bit of breathing room. But don’t break out the champagne just yet—food prices are still climbing, and that’s keeping policymakers on edge. It’s a mixed bag: some relief on the horizon, but not enough to call off the fight against rising costs.

Editor’s Note: Inflation cooling down sounds like good news, right? Well, sort of. While the overall trend is easing, everyday essentials like groceries are still pinching wallets, which means the BOJ isn’t out of the woods. This story matters because Japan’s economy has been stuck in a low-inflation rut for years, and now that prices are finally moving, getting the balance right is tricky. Too much tightening could stall growth, but ignoring stubborn food inflation risks leaving households squeezed. It’s a high-stakes tightrope walk.

Japan's core inflation slows but stays above BOJ target, keeps hike bets alive

NeutralFinancial Markets

Japan’s core inflation rate has cooled slightly but remains stubbornly above the Bank of Japan’s 2% target, keeping alive speculation that the central bank might raise interest rates soon. While the slowdown suggests some relief from price pressures, policymakers are still grappling with whether the trend is sustainable enough to justify tightening monetary policy.

Editor’s Note: Inflation sticking above target is a big deal for Japan, which has battled deflation for decades. If prices keep rising, the BOJ might finally ditch its ultra-loose policies—a move that could ripple through global markets. But with growth still shaky, it’s a tough call, and everyone’s watching for hints on what comes next.

Japan CPI inflation eases in June, core print remains above BOJ target

NeutralFinancial Markets

Japan’s consumer price inflation slowed down in June, but the core figure—which strips out volatile food and energy costs—stayed stubbornly above the Bank of Japan’s 2% target. It’s a mixed signal for policymakers: while overall price pressures are easing, the underlying trend suggests inflation isn’t going away quietly.

Editor’s Note: This isn’t just a numbers game—it’s a headache for the BOJ. They’ve been wrestling with weak inflation for years, and now that prices are finally rising, they’re stuck figuring out whether this is a blip or a lasting shift. For everyday folks, it’s a reminder that higher costs (especially for essentials) might stick around, even if the headline rate cools off. Investors, meanwhile, are watching closely for hints on when—or if—the central bank might tweak its ultra-loose policies.

Why World Pulse Now?

Global Coverage

All major sources, one page

Emotional Lens

Feel the mood behind headlines

Trending Topics

Know what’s trending, globally

Read Less, Know More

Get summaries. Save time

Stay informed, save time

Learn moreLive Stats

Articles Processed

8,516

Trending Topics

122

Sources Monitored

204

Last Updated

41 minutes ago

Live data processing

How it works1-Minute Daily Briefing

Stay sharp in 60 seconds. Get concise summaries of today’s biggest stories — markets, tech, sports, and more

Why World Pulse Now?

Global Coverage

All major sources, one page

Emotional Lens

Feel the mood behind headlines

Trending Topics

Know what’s trending, globally

Read Less, Know More

Get summaries. Save time

Stay informed, save time

Learn moreLive Stats

Articles Processed

8,516

Trending Topics

122

Sources Monitored

204

Last Updated

41 minutes ago

Live data processing

How it works1-Minute Daily Briefing

Stay sharp in 60 seconds. Get concise summaries of today’s biggest stories — markets, tech, sports, and more