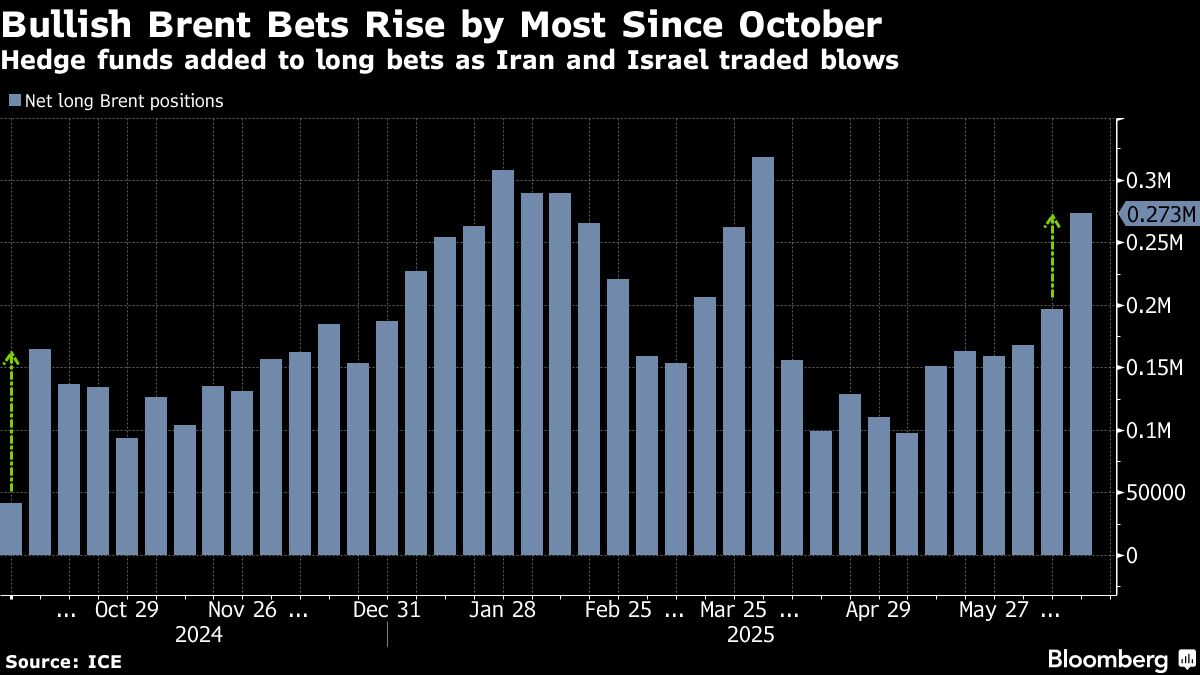

Hedge funds and US producers are aggressively betting on oil amid Middle East tensions, but prices dipped after Trump signaled patience with Iran talks, while hedging hits record highs.

Why World Pulse Now?

Global Coverage

All major sources, one page

Emotional Lens

Feel the mood behind headlines

Trending Topics

Know what’s trending, globally

Read Less, Know More

Get summaries. Save time

Live Stats

7,101

150

211

in 2 hours

Mobile App

Get instant summaries, explore trending stories, and dive deeper into the headlines — all in one sleek, noise-free mobile experience.

1-Minute Daily Briefing

Stay sharp in 60 seconds. Get concise summaries of today’s biggest stories — markets, tech, sports, and more

Why World Pulse Now?

Global Coverage

All major sources, one page

Emotional Lens

Feel the mood behind headlines

Trending Topics

Know what’s trending, globally

Read Less, Know More

Get summaries. Save time

Live Stats

7,101

150

211

in 2 hours

Mobile App

Get instant summaries, explore trending stories, and dive deeper into the headlines — all in one sleek, noise-free mobile experience.

1-Minute Daily Briefing

Stay sharp in 60 seconds. Get concise summaries of today’s biggest stories — markets, tech, sports, and more