Artificial Intelligence

Bernstein to cut up to 28 roles in France as part of future growth plans

NegativeArtificial Intelligence

Bernstein is set to cut up to 28 roles in France as part of its future growth plans, following the establishment of a joint venture with Societe Generale and AllianceBernstein announced in 2024. The redundancies are being made on a voluntary basis, as confirmed by The TRADE.

Ediphy unveils trading and analytics API suite in a bid to automate fixed income markets

PositiveArtificial Intelligence

Ediphy has launched a new trading and analytics API suite aimed at automating fixed income markets, allowing firms to concentrate on their trading strategies rather than the complexities of market infrastructure. This initiative reflects a growing trend towards automation in financial services.

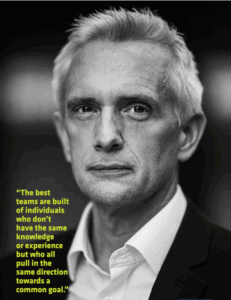

UBS Asset Management’s Stuart Lawrence on challenging the status quo

PositiveArtificial Intelligence

Stuart Lawrence, head of European equities trading at UBS Asset Management and named Industry Person of the Year 2025, discusses his career journey and future ambitions in an interview with Claudia Preece. He reflects on his extensive 25 years of experience in the industry, highlighting the challenges and lessons learned along the way.

U.S. Bancorp set to acquire BTIG in $1 billion deal

PositiveArtificial Intelligence

U.S. Bancorp has announced its intention to acquire BTIG in a deal valued at $1 billion, aiming to enhance its capital markets platform and provide deeper support for institutional clients. The acquisition is expected to close in the second quarter of 2026.

LSEG unveils two new trade surveillance solutions

NeutralArtificial Intelligence

LSEG has introduced two new trade surveillance solutions focused on foreign exchange (FX) and the Markets in Financial Instruments Directive (MiFID), aimed at enhancing insights into trading behavior. This development is part of LSEG's ongoing efforts to improve market oversight and compliance.

DTCC unveils industry-wide testing phase for US equities 24/5 trading

NeutralArtificial Intelligence

The Depository Trust & Clearing Corporation (DTCC) has announced the initiation of an industry-wide testing phase for 24/5 trading of US equities, a significant step towards expanding trading hours beyond traditional limits. This move is expected to facilitate exchanges like NYSE, Nasdaq, and Cboe in adapting to a more flexible trading environment.