Financial Markets

Platinum Soars to Record Above $2,300 on Tight Global Supplies

PositiveFinancial Markets

Platinum prices have surged to an unprecedented level, exceeding $2,300 an ounce, driven by tight global supplies and high borrowing costs. This marks a significant milestone for the metal, reflecting strong demand amid constrained availability.

Won Jumps After Korea Vows ‘Strong Determination’ Over Currency

PositiveFinancial Markets

The South Korean won experienced a notable increase following statements from authorities indicating that excessive weakness in the currency is undesirable and that the government will demonstrate strong determination in foreign-exchange markets. This response reflects a proactive stance to stabilize the currency amid economic fluctuations.

Decorated Army Veteran Builds Second Career in the Bourbon Business

PositiveFinancial Markets

Lofted Spirits, led by retired US Army Colonel Mark Erwin, is thriving in the bourbon industry with its brands Bardstown Bourbon and Green River, despite challenges posed by tariffs in the alcohol market. Erwin discussed the company's strategies for success during an interview on Bloomberg Businessweek Daily.

S&P 500 Hits Record High on Thin Volume | The Close 12/23/2025

PositiveFinancial Markets

The S&P 500 index reached a record high on December 23, 2025, closing at an all-time peak, as reported by Bloomberg Television. This milestone was achieved despite thin trading volume, indicating strong investor confidence in the market's resilience.

Gold Soars Above $4,500 for First Time on Geopolitics, Rates

PositiveFinancial Markets

Gold prices have surged to a record high, surpassing $4,500 an ounce for the first time, driven by escalating geopolitical tensions in Venezuela and anticipations of further interest rate cuts by the US Federal Reserve.

Oil Holds Five-Day Gain With Geopolitics, Inventories in Focus

NeutralFinancial Markets

Oil prices have maintained a five-day gain as traders navigate escalating geopolitical tensions alongside increasing inventories. This stability reflects a complex interplay between supply dynamics and market sentiment, with traders weighing potential disruptions against a backdrop of rising stock levels.

Tricolor CEO Collected $30 Million in Year Before Alleged Fraud

NegativeFinancial Markets

Daniel Chu, the founder of Tricolor Holdings, received nearly $30 million in compensation in the year preceding the company's collapse, which is now under scrutiny due to allegations of fraud as detailed in a lawsuit by the trustee managing the liquidation process.

China’s Comac on Track to Miss C919 Delivery Target by Half

NegativeFinancial Markets

Commercial Aircraft Corp of China Ltd. is projected to miss its revised delivery target for the C919 single-aisle jet by half, a setback attributed to production challenges exacerbated by trade tensions. This development raises concerns about the company's ability to compete in the global aviation market.

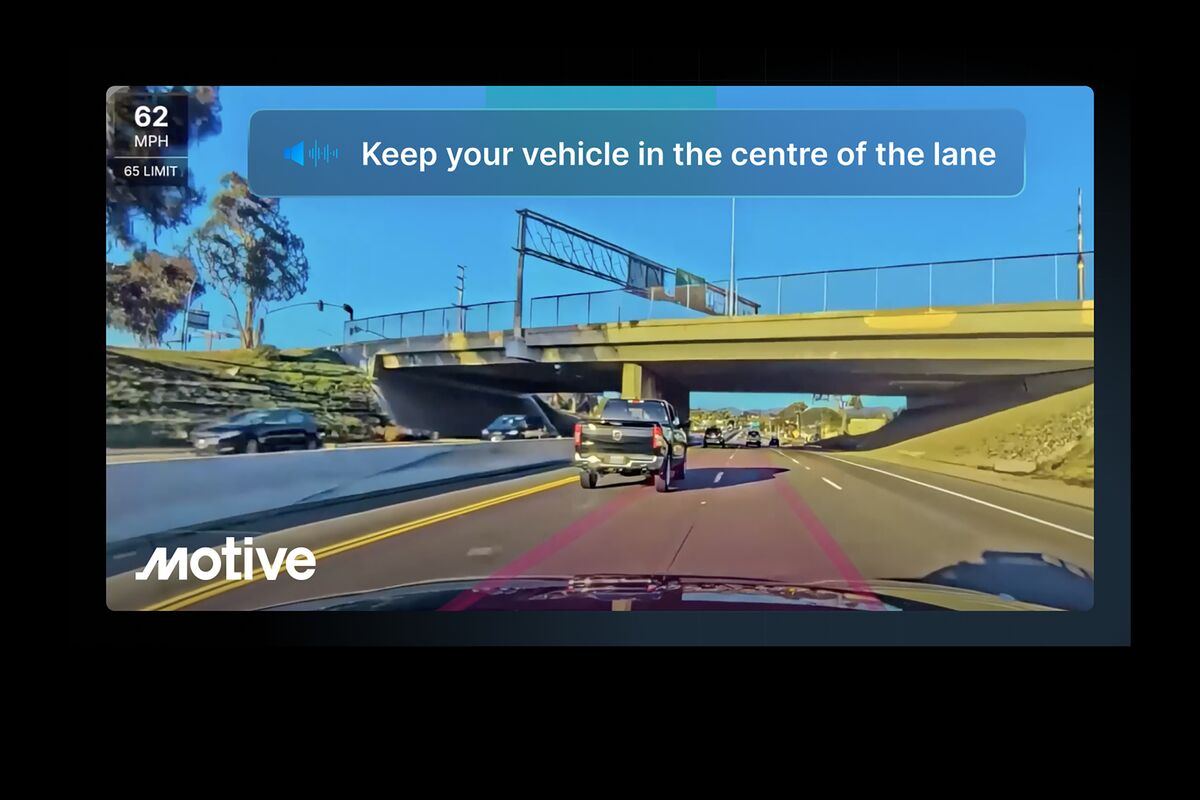

Google-Backed Fleet Tracking Firm Motive Files Publicly for IPO

NeutralFinancial Markets

Motive Technologies Inc., a fleet management software firm supported by Google, has publicly filed for an initial public offering (IPO), revealing both increasing revenue and net losses. This move marks a significant step for the company as it seeks to expand its operations and attract investment.