Big Tech’s ‘Spend Little, Earn Lots’ Formula Is Threatened By AI

NegativeTechnology

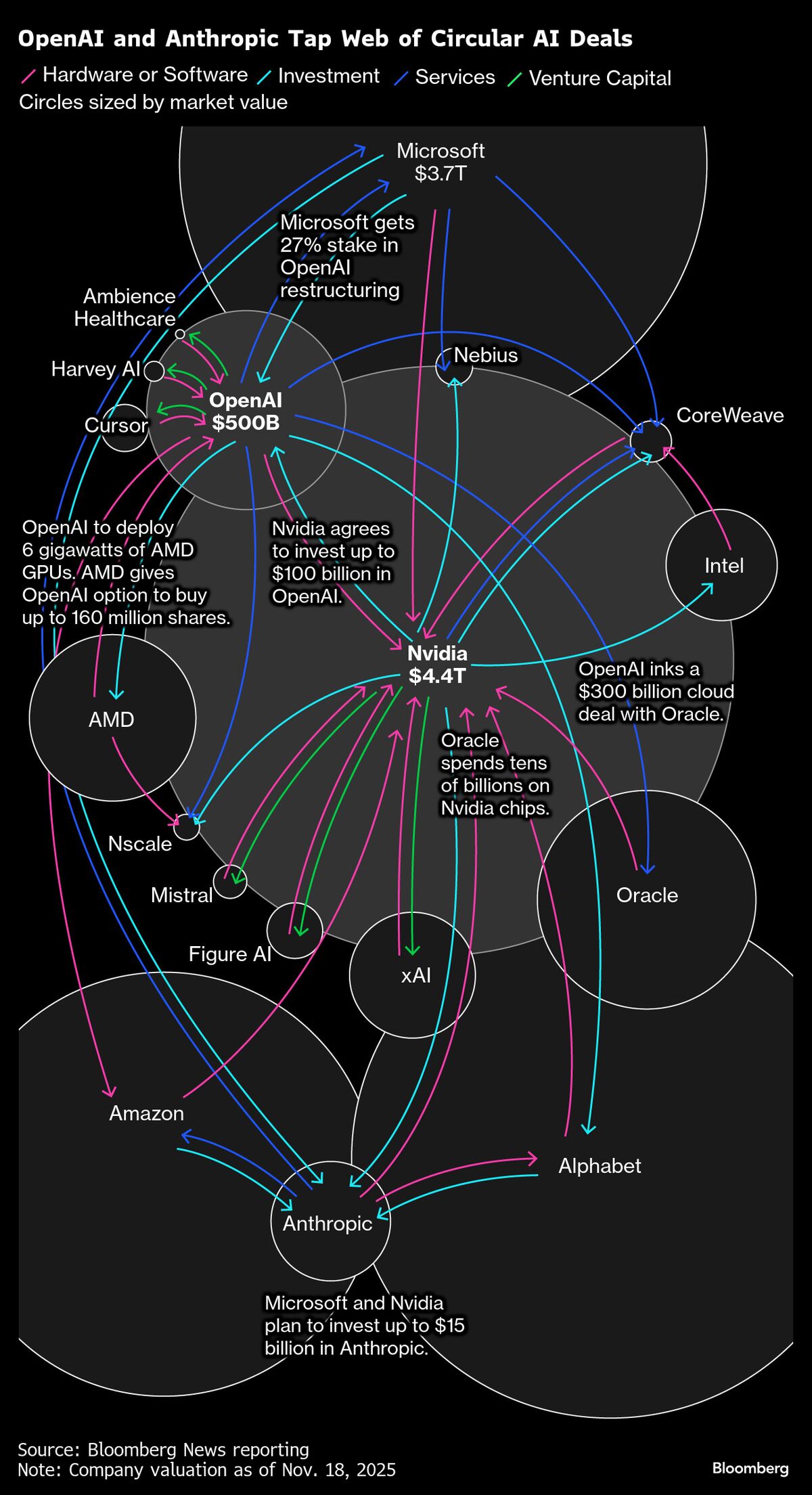

- Big Tech's longstanding strategy of minimizing spending while maximizing earnings is facing significant challenges due to the rapid advancements in artificial intelligence (AI). This shift threatens the traditional business models that have driven growth for two decades, as companies are now compelled to invest heavily in AI technologies to remain competitive.

- The implications of this shift are profound for Big Tech companies, which are now grappling with the need to balance substantial investments in AI with the potential for diminishing returns. As these firms increase their spending, concerns about financial sustainability and profitability are rising among investors and analysts alike.

- This development reflects a broader trend in the tech industry, where the surge in AI investments is reminiscent of previous market booms, raising fears of a potential bubble. Additionally, the reliance on AI for decision-making in venture capital and the emergence of AI-driven competitors in e-commerce further complicate the landscape, highlighting the transformative yet risky nature of AI integration in business.

— via World Pulse Now AI Editorial System