HPE’s AI Servers Ready as Soon Data Centers Are, Says CEO

NegativeTechnology

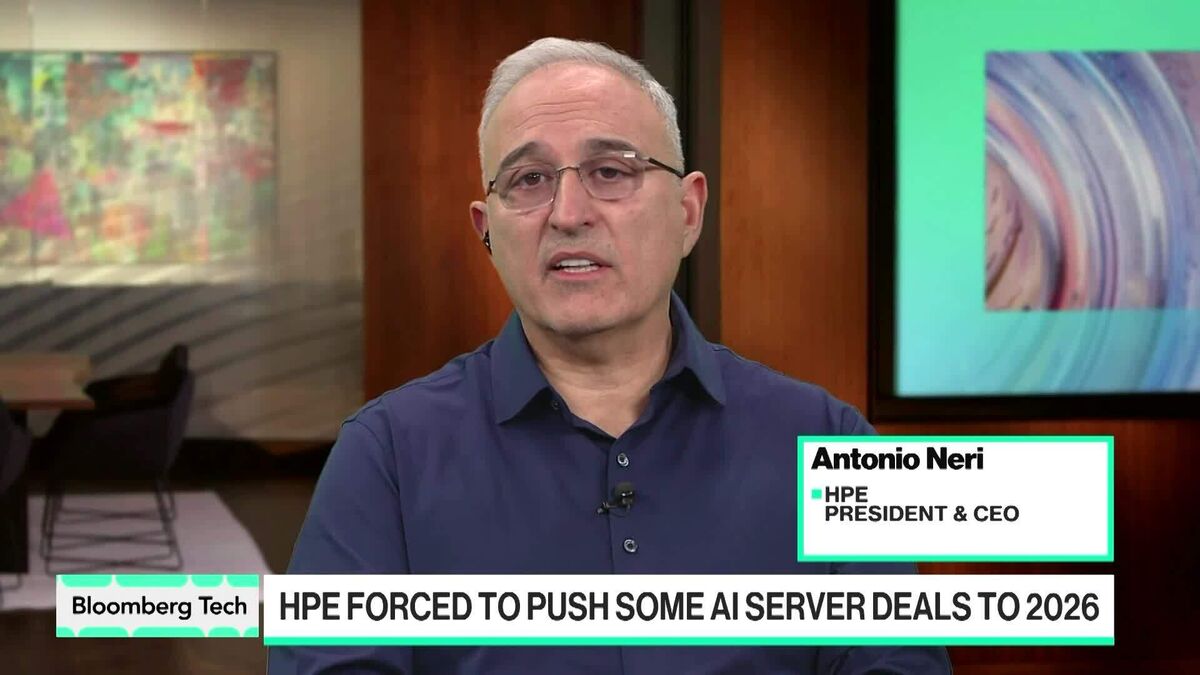

- HPE CEO Antonio Neri reported that the company's sales for AI servers have not met expectations, despite the readiness of these servers as data centers become available. This announcement was made during an interview on Bloomberg Tech with Caroline Hyde and Ed Ludlow.

- The disappointing sales outlook is significant for HPE, as it projects revenues between $9 billion and $9.4 billion, falling short of analysts' expectations of $9.88 billion. This shortfall may impact investor confidence and the company's market position in the competitive AI sector.

- The broader context reveals a challenging landscape for AI technology companies, with contrasting fortunes among industry players. While HPE struggles with sales, competitors like Nvidia are reporting strong earnings, highlighting a divide in market performance amid ongoing discussions about the sustainability of the AI boom.

— via World Pulse Now AI Editorial System