Oracle Drops on Disappointing Cloud Sales

NegativeTechnology

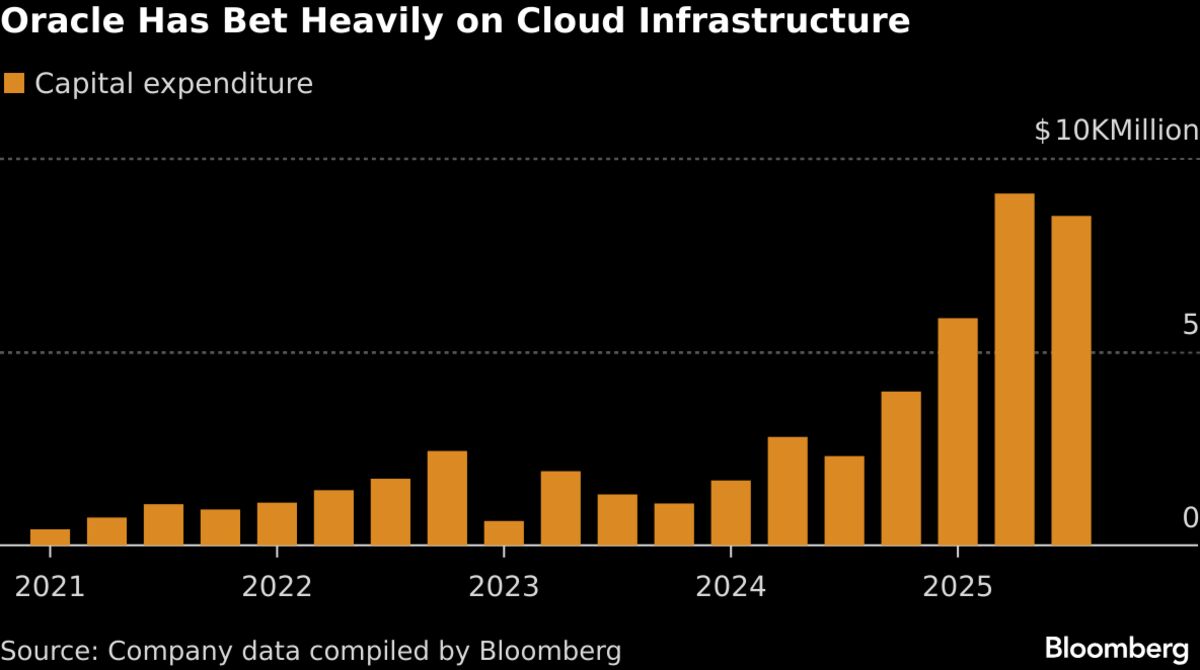

- Oracle Corp. reported a 34% increase in fiscal second-quarter cloud sales, reaching $7.98 billion, alongside a 68% rise in infrastructure revenue to $4.08 billion. However, both figures fell short of analysts' expectations, leading to a drop in the company's stock price by over 10% in after-hours trading. This disappointing performance coincided with a significant rise in spending on AI data centers and equipment.

- The shortfall in cloud sales and the increased expenditure on AI initiatives raise concerns about Oracle's ability to generate profits from its substantial investments. The company's credit risk has also deteriorated, reflecting investor apprehension regarding its financial stability and future profitability in a competitive market.

- The situation highlights broader concerns within the technology sector, particularly regarding the sustainability of investments in artificial intelligence. As Oracle faces heightened credit risk and investor skepticism, the ongoing debate about the viability of AI-driven business models intensifies, with many tech firms grappling with similar challenges amid fears of an AI bubble.

— via World Pulse Now AI Editorial System