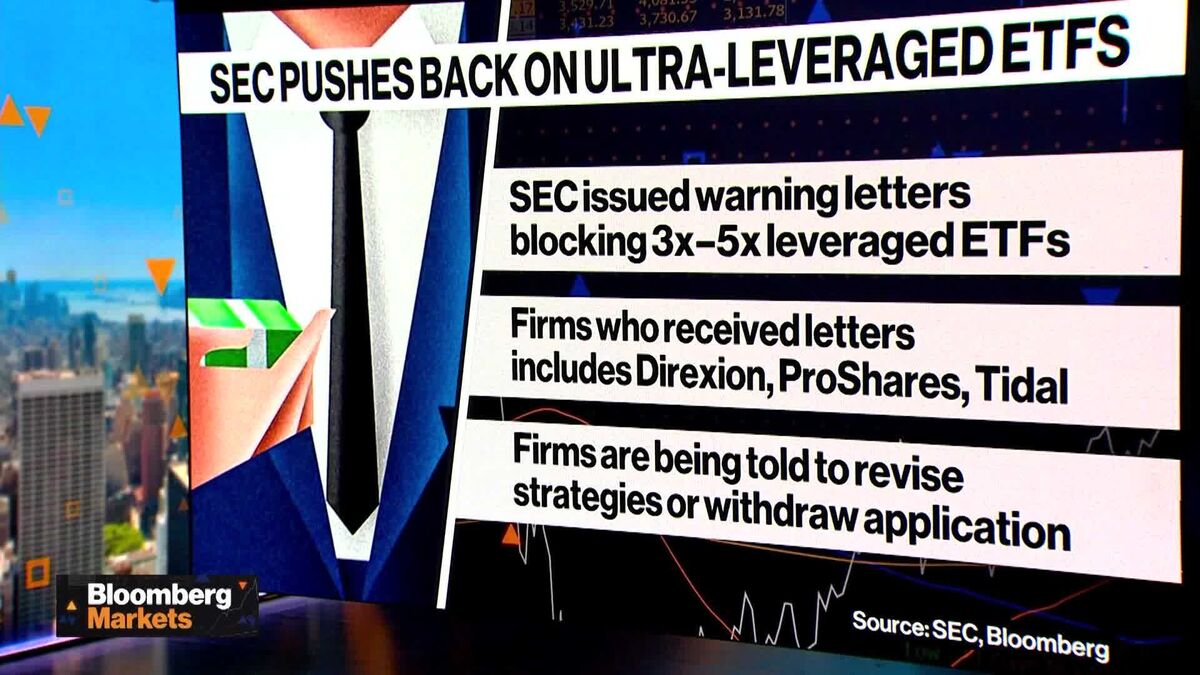

SEC Halts High-leveraged ETF Plans

NegativeTechnology

- The SEC has issued warning letters to major providers of high-leveraged ETFs, effectively blocking the launch of products aimed at delivering returns of three to five times the daily performance of various assets, including stocks and cryptocurrencies. This decision reflects the regulatory body's concerns over the risks associated with such investment vehicles.

- This development is significant as it halts the expansion of high-risk financial products that could potentially expose investors to substantial losses, particularly in volatile markets. The SEC's actions indicate a cautious approach towards maintaining market stability and investor protection.

- The SEC's intervention comes at a time when the financial landscape is witnessing fluctuations, such as Bitcoin's recent recovery above $90,000 after a major selloff. This juxtaposition highlights ongoing debates about the appropriateness of leveraged products in the current market environment, as investors grapple with both opportunities and risks.

— via World Pulse Now AI Editorial System