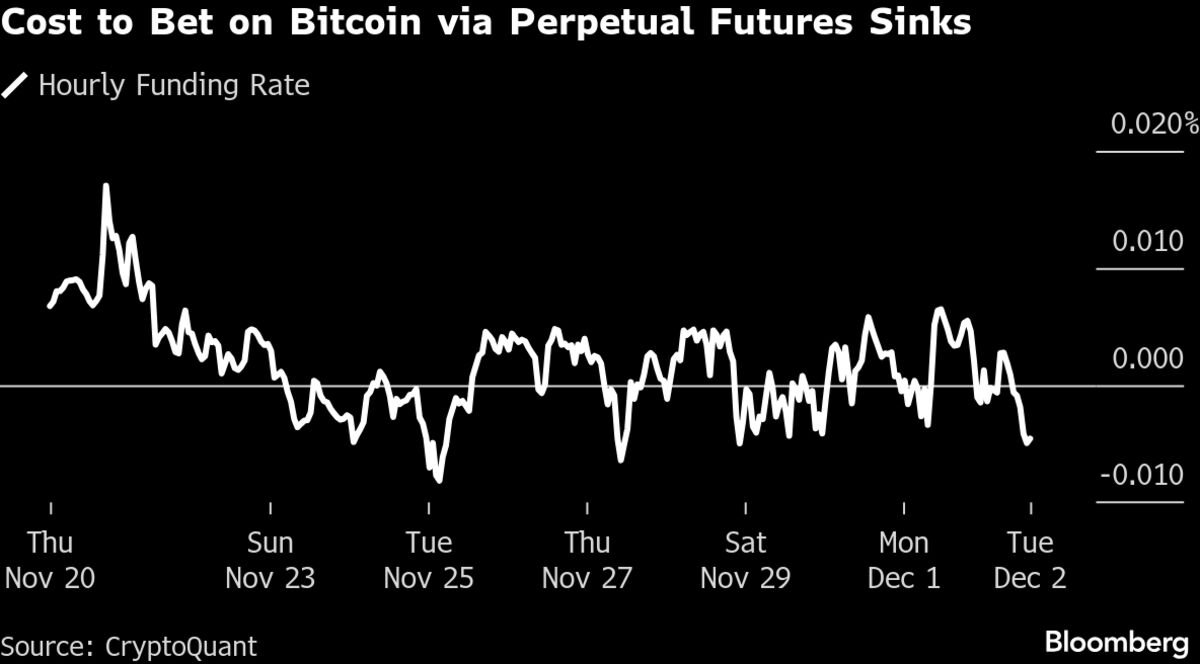

Crypto Markets Steady as Indicators Point to Weak Sentiment

NegativeTechnology

- Crypto markets showed signs of stabilization on Tuesday following a significant sell-off the previous day, with various indicators suggesting that traders remain hesitant to engage in buying despite the dip. This cautious sentiment reflects ongoing volatility within the cryptocurrency sector.

- The current state of the crypto markets is critical as it highlights traders' reluctance to invest, which could hinder recovery efforts and affect market confidence. The performance of Bitcoin, in particular, is under scrutiny as it faces its worst monthly performance since the 2022 crypto collapse.

- This situation underscores a broader trend of uncertainty in the cryptocurrency market, where traders are grappling with mixed signals from both crypto and traditional equity markets. The recent fluctuations in Bitcoin's price, alongside the downturn in technology stocks, indicate a complex interplay of factors influencing investor behavior and market stability.

— via World Pulse Now AI Editorial System