AI Spending Anchoring Macroeconomy: Board’s Gallagher

PositiveTechnology

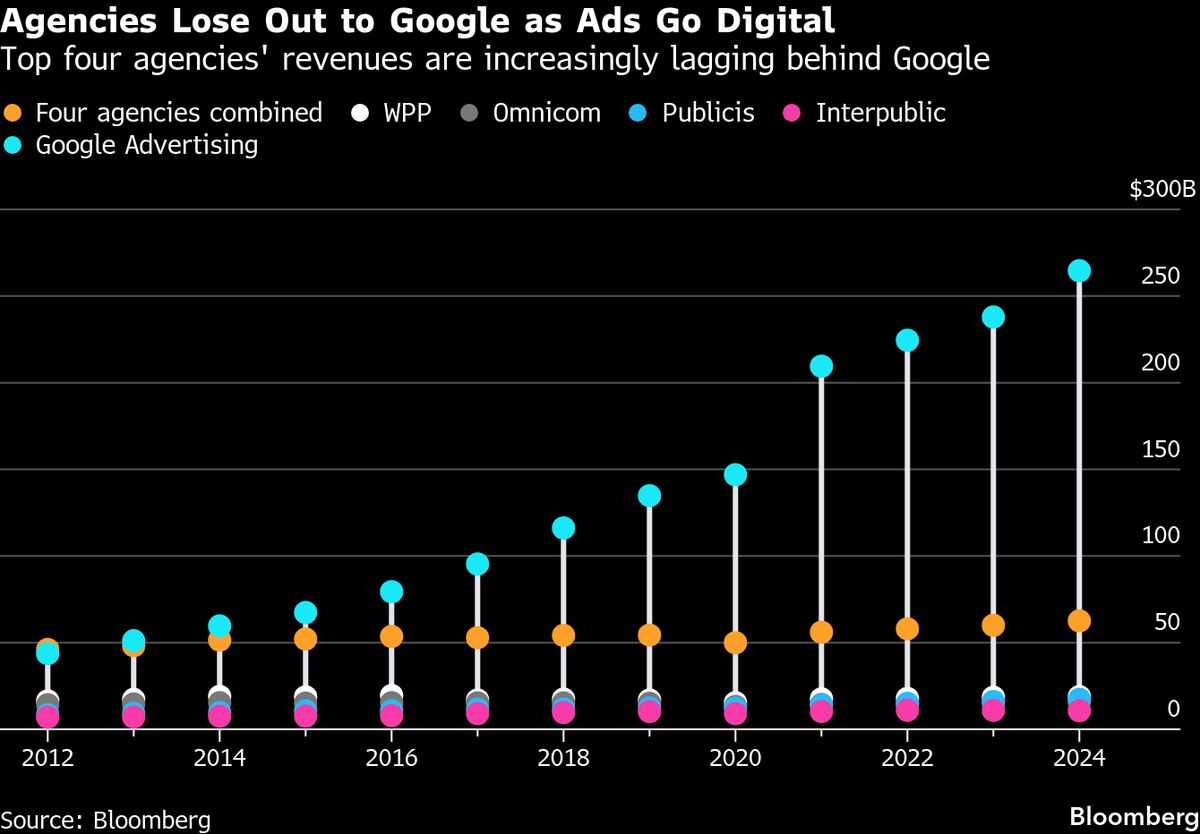

- Natalie Gallagher, principal economist at Board, emphasized that the recent surge in artificial intelligence (AI) spending is not just a trend but a significant anchor for the broader economy, as discussed on Bloomberg Tech with Caroline Hyde.

- This development is crucial for Board as it highlights the company's role in the AI sector, showcasing how AI investments are stabilizing economic conditions and potentially leading to increased demand for AI-driven solutions.

- The AI landscape is evolving, with venture capitalists increasingly trusting AI for investment decisions, while concerns about a potential market bubble and the sustainability of AI spending loom, reflecting a complex interplay of optimism and caution in the tech industry.

— via World Pulse Now AI Editorial System