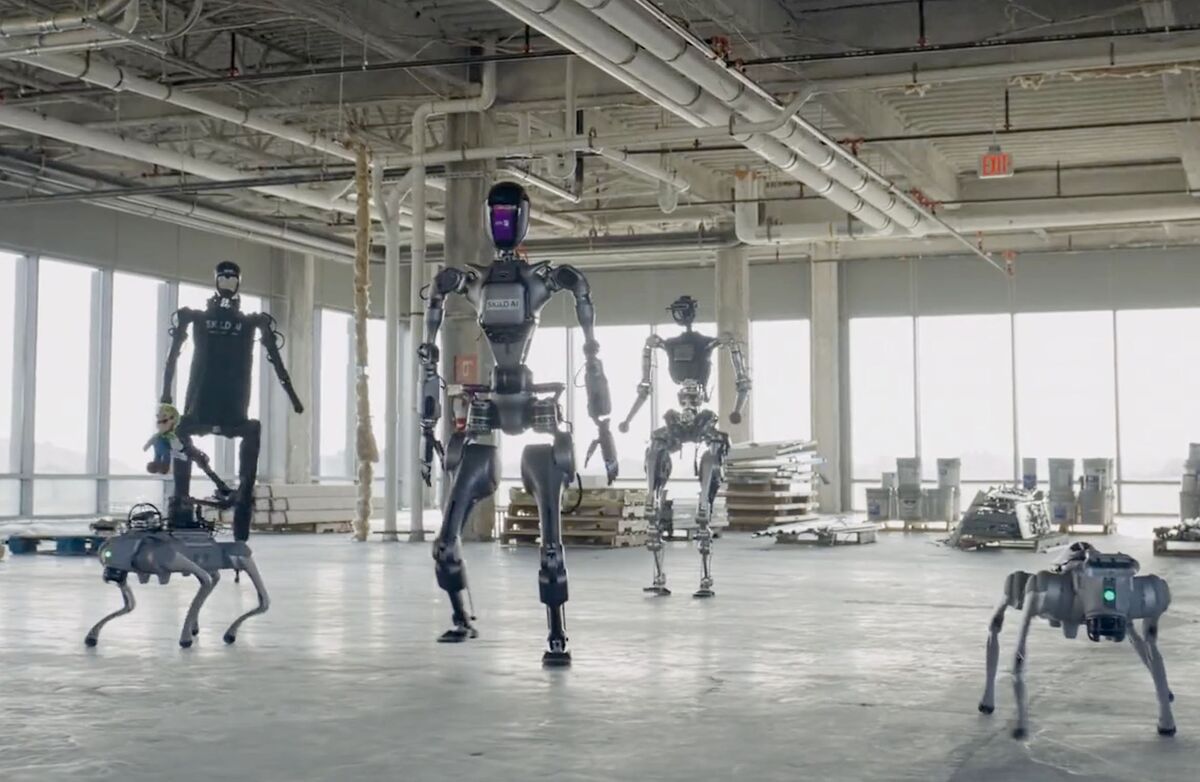

Baidu Posts Worst Sales Fall on Record Despite Major AI Spending

NegativeTechnology

- Baidu Inc. has experienced its most significant quarterly revenue drop ever, which raises alarms about its advertising sector's viability. The company's efforts to invest heavily in artificial intelligence have not yet translated into financial stability, indicating potential weaknesses in its business model.

- This development is critical as it underscores the challenges Baidu faces in a competitive market. The decline in revenue could impact investor confidence and the company's ability to innovate, potentially hindering its long

— via World Pulse Now AI Editorial System