Economy and AI Push Make Shorting US Stocks Dangerous, 22V Says

PositiveTechnology

- This month, investors considering shorting US stocks are advised to reconsider due to the robust performance of the American economy and the prevailing excitement surrounding artificial intelligence (AI), as noted by 22V. The combination of these factors suggests a potentially risky environment for betting against the market.

- The strength of the US economy, coupled with the ongoing AI enthusiasm, indicates a favorable outlook for stock performance, making shorting a less attractive option for investors. This sentiment reflects a broader confidence in market resilience amidst technological advancements.

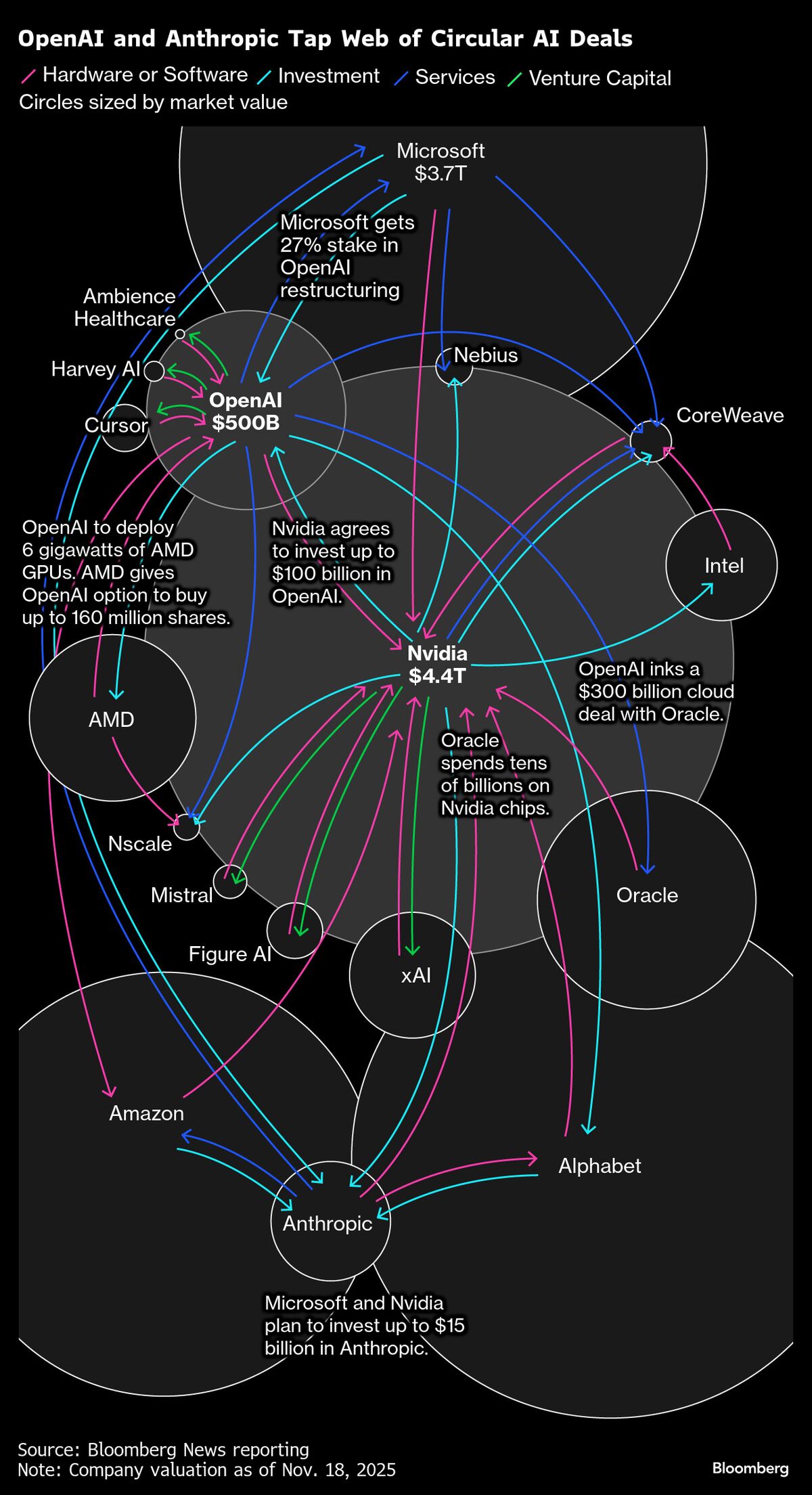

- The current landscape highlights a juxtaposition between the optimism surrounding AI investments and concerns about potential market bubbles, particularly in the tech sector. While some analysts advocate for focusing on Asian markets for AI exposure, others warn of the risks associated with high valuations and debt levels in the US, suggesting a complex and evolving investment climate.

— via World Pulse Now AI Editorial System