Markets soothed by AI chip maker's results but bubble concerns haven't gone away

PositiveTechnology

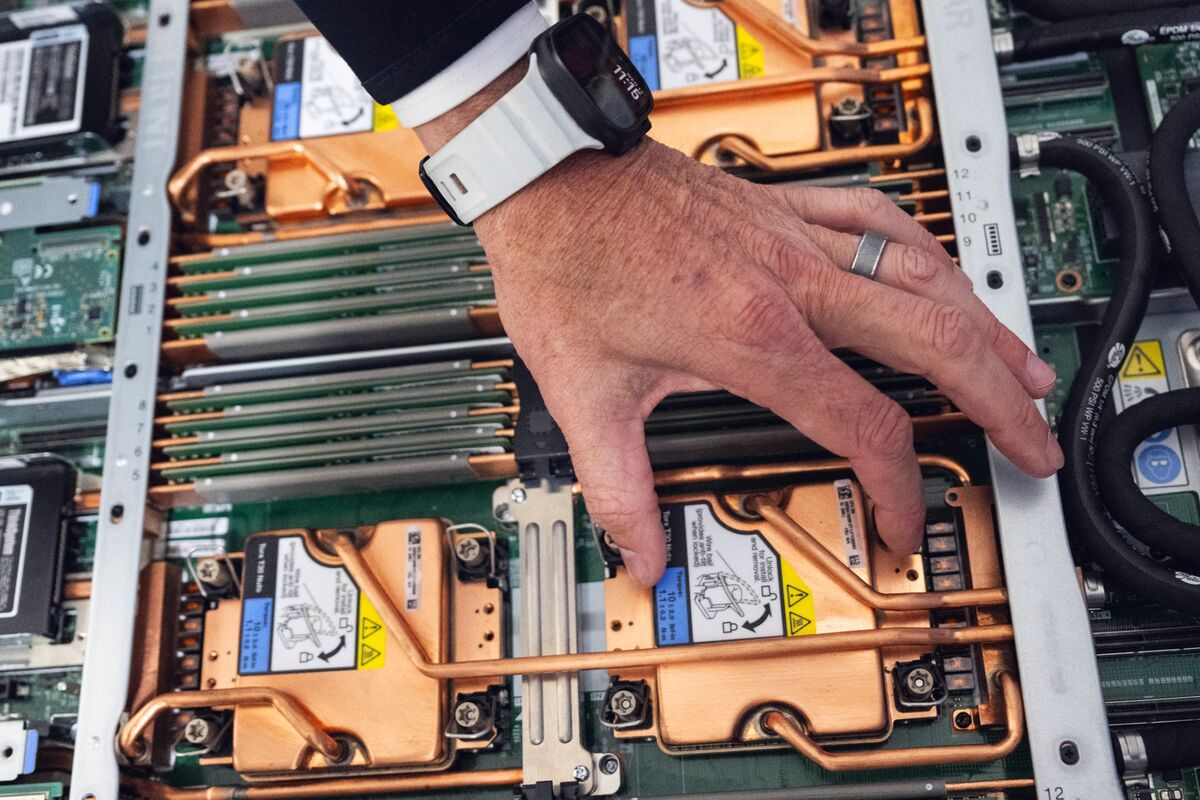

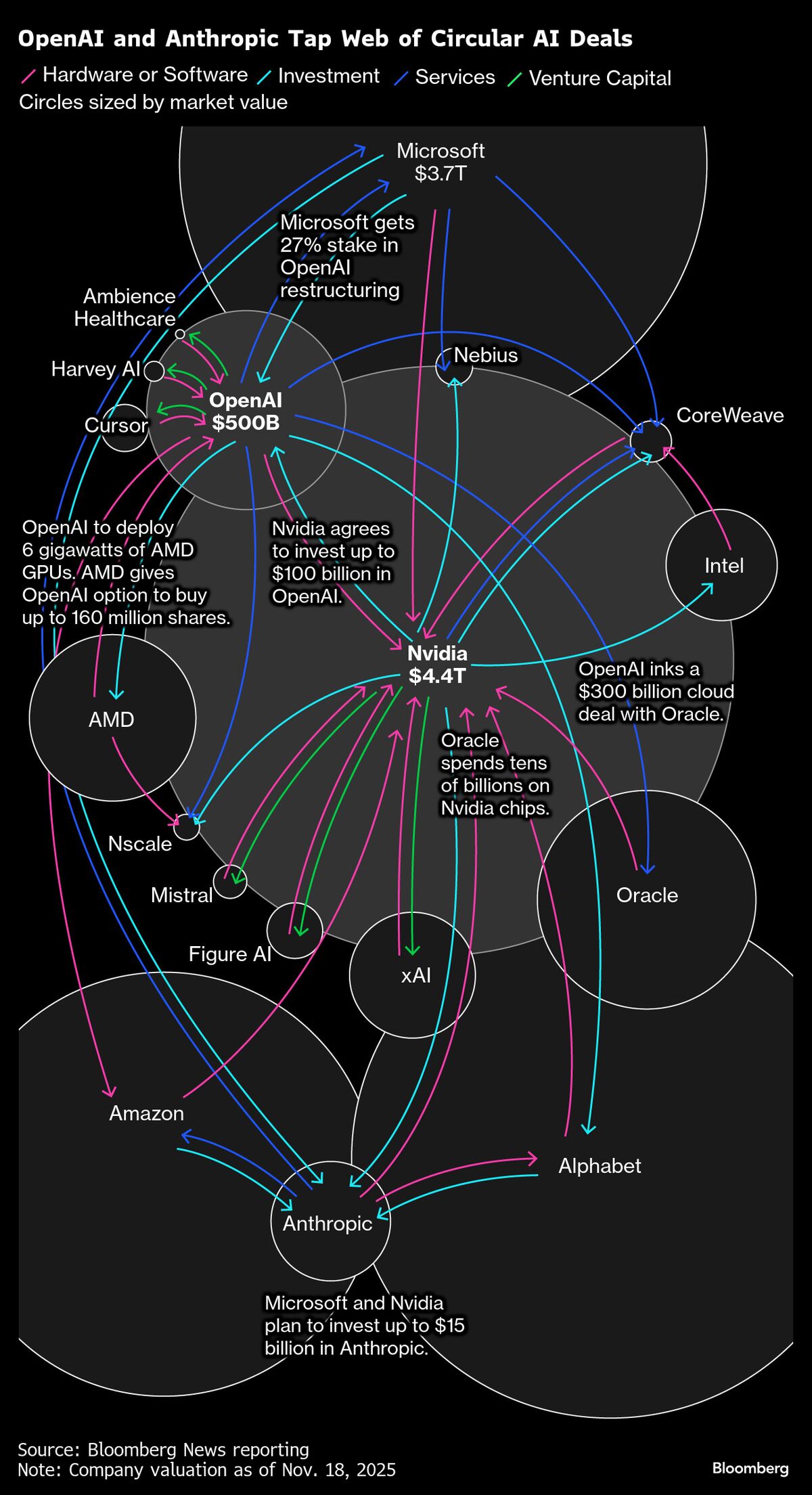

- Global stock markets have rallied as a leading AI chip maker reassured investors about strong demand for artificial intelligence technologies, highlighting the potential for significant returns in this sector.

- This development is crucial as it reflects investor confidence in the AI market, which has been a driving force behind recent stock market gains, particularly in technology sectors.

- However, underlying concerns about inflated valuations and the sustainability of the current market rally continue to loom, as evidenced by recent sell-offs and mixed earnings reports from major tech companies.

— via World Pulse Now AI Editorial System