Maybe Weakness Isn't All Oracle's Fault: 3-Minutes MLIV

NeutralTechnology

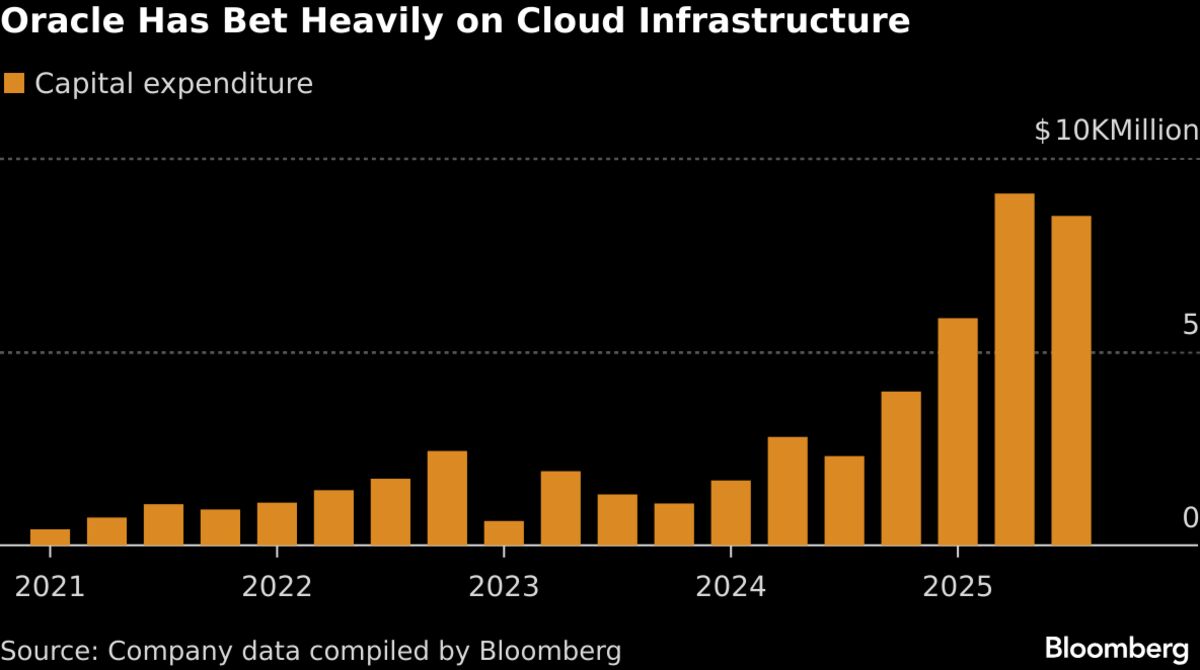

- Analysts Anna Edwards, Guy Johnson, and Mark Cudmore discussed the recent performance of Oracle Corp., highlighting that the company's current weaknesses may not solely be its fault. This commentary comes amid concerns regarding Oracle's financial health following its latest earnings report, which indicated rising credit risks due to increased spending on data centers and AI equipment.

- The deterioration in Oracle's credit risk gauge, now at its highest since 2009, raises significant concerns about the company's profitability and ability to manage its substantial investments in artificial intelligence and cloud services. Investors are particularly worried about the slow revenue generation from these investments.

- This situation reflects broader market anxieties, particularly around the tech sector's heavy investments in AI amidst fears of a potential bubble. Analysts have noted a complex interplay between soaring stock valuations and the challenges investors face in executing sales, suggesting a cautious outlook for the technology market as it navigates these turbulent waters.

— via World Pulse Now AI Editorial System