Big Tech’s AI Debt Wave Threatening to Swamp Credit Markets

NegativeTechnology

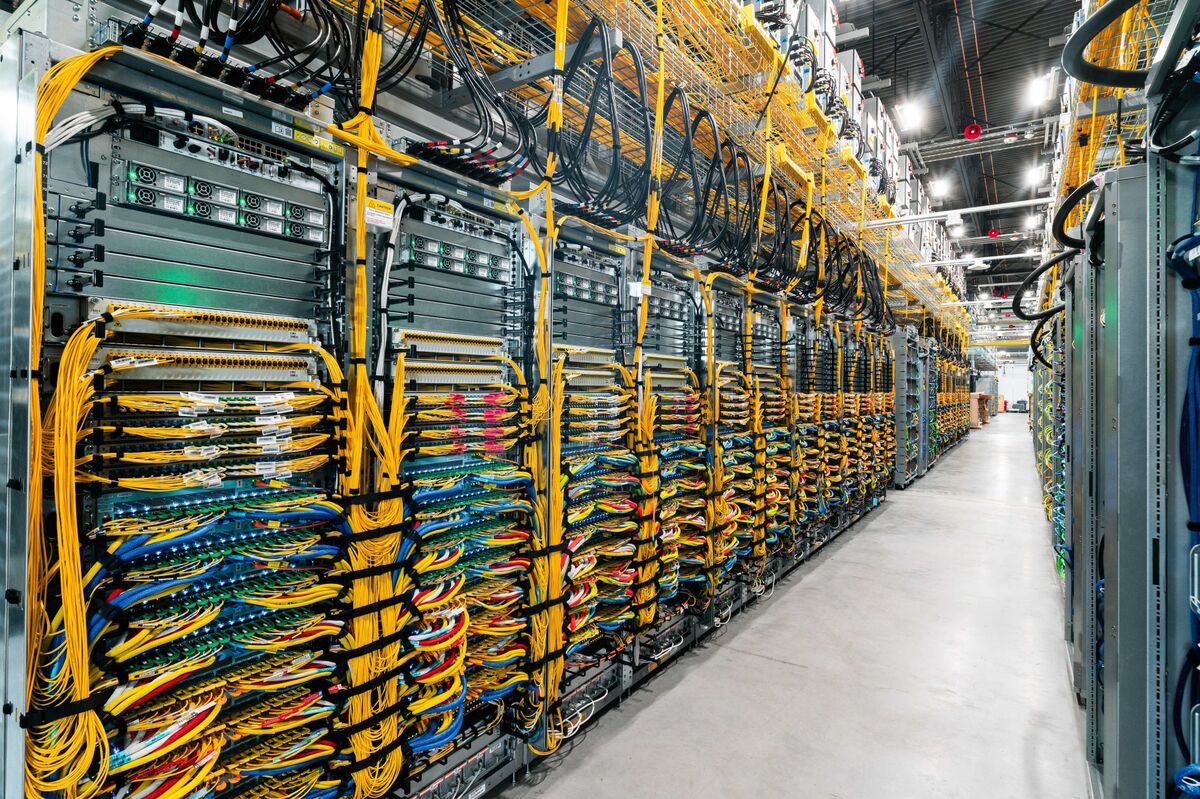

- A significant wave of debt sales from Big Tech companies is threatening to overwhelm credit markets, raising concerns about potential weaknesses on both sides of the Atlantic. This surge in borrowing is primarily aimed at expanding artificial intelligence infrastructure, which has become a focal point for these companies.

- The accumulation of high levels of debt poses risks not only to the financial stability of these tech giants but also to the broader credit market, as investors express increasing anxiety over the sustainability of such financial strategies amid fears of a market bubble.

- This situation reflects a growing tension in the tech industry, where the race to dominate AI is leading to aggressive financial maneuvers. Additionally, regulatory shifts, particularly in Europe, may further embolden these companies, potentially resulting in fewer restrictions and increased market volatility.

— via World Pulse Now AI Editorial System