Why Investors Are Pricing in Risk of K-Shaped Economy

NeutralTechnology

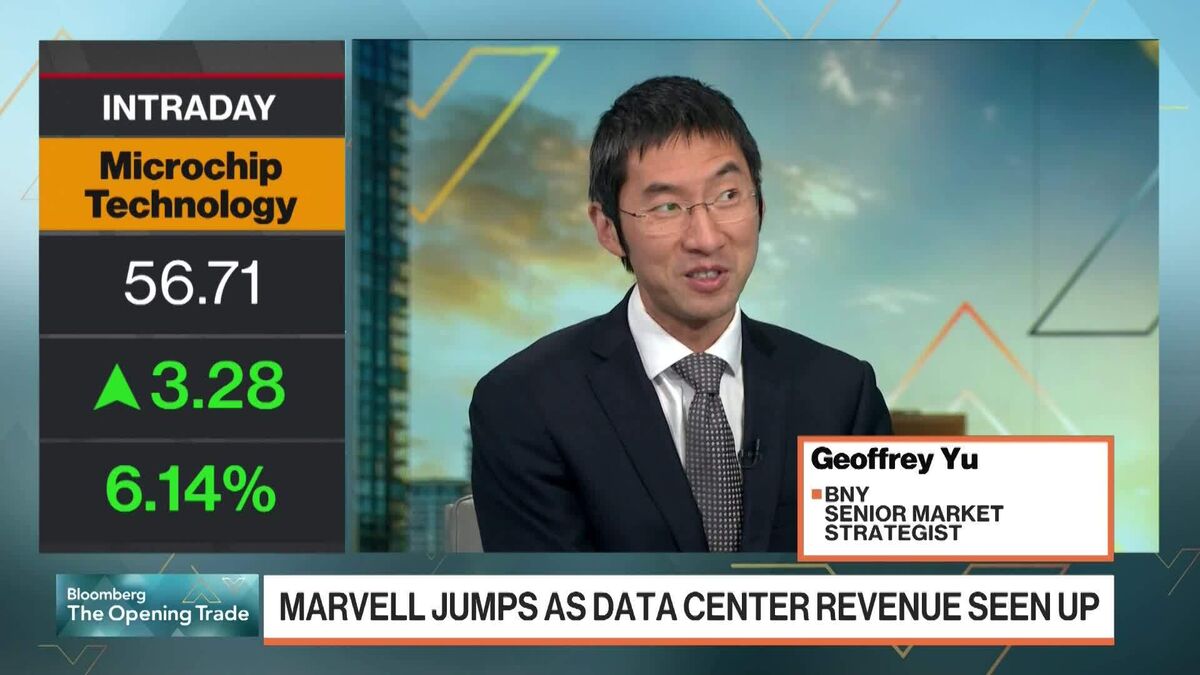

- BNY Strategist Geoffrey Yu has indicated that investors are factoring in the risk of a K-shaped economy in the US, where higher-income consumers continue to spend while lower-income individuals reduce their expenditures due to inflation. This trend is reflected in the declining exposure of clients to US consumer-related stocks, particularly in discretionary staples like food production.

- This development is significant as it highlights the growing economic divide in consumer behavior, suggesting that companies may need to adjust their strategies to cater to the differing needs of these income groups, potentially impacting market dynamics and investment strategies.

— via World Pulse Now AI Editorial System