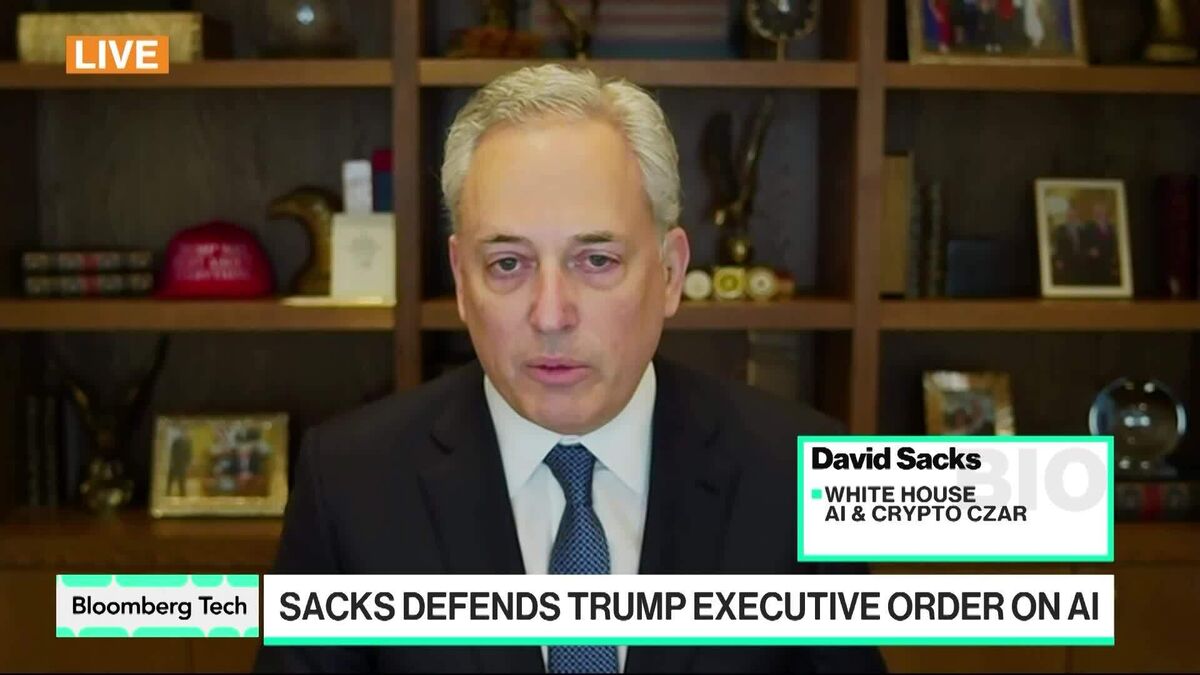

China Is ‘Rejecting’ H200s, Outfoxing US Strategy, Sacks Says

NegativeTechnology

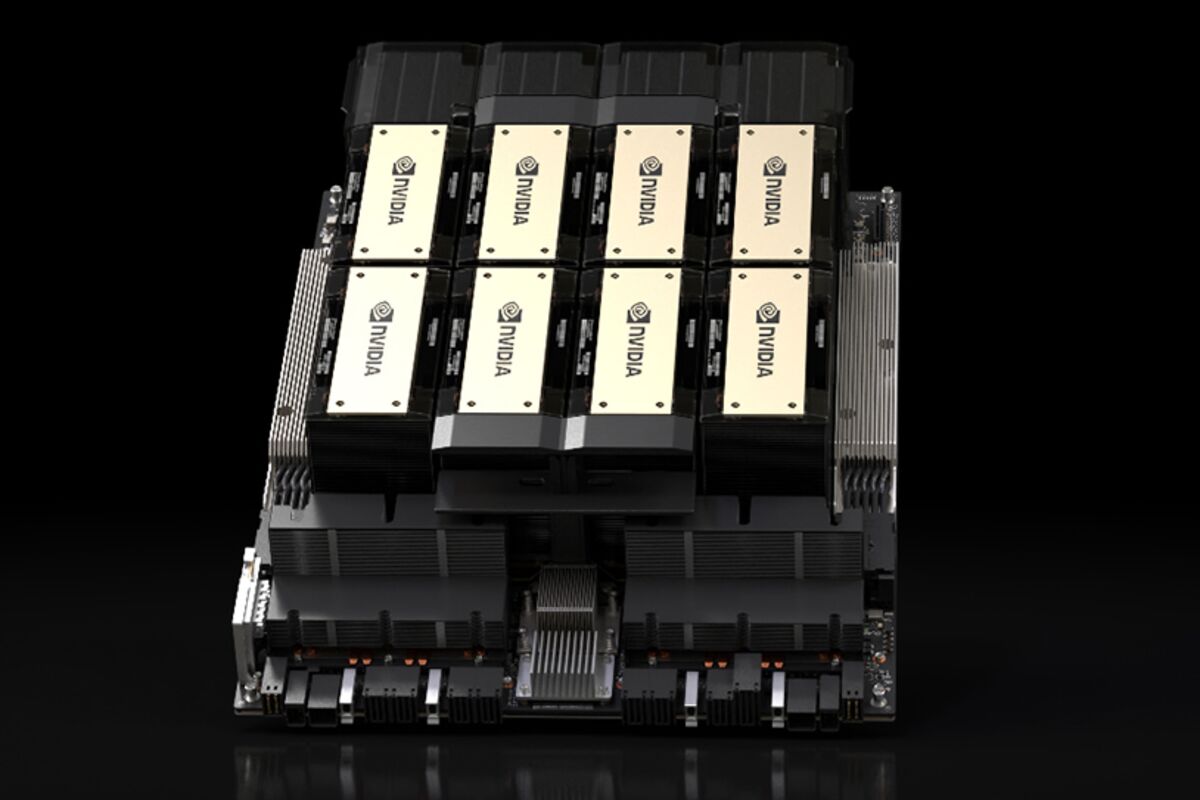

- China has decided to reject the purchase of Nvidia's H200 AI chips, opting instead for domestically produced semiconductors. This decision comes as the U.S. has attempted to facilitate Nvidia's sales to China, which were previously restricted due to national security concerns, as noted by White House AI czar David Sacks.

- The rejection of the H200 chips by China signifies a strategic shift towards self-reliance in semiconductor technology, potentially impacting Nvidia's market share and revenue in a crucial market that has been opened up by U.S. policy changes.

- This development highlights the ongoing tensions in U.S.-China relations regarding technology and trade, as well as the competitive landscape in the AI sector, where domestic capabilities are increasingly prioritized over foreign imports, reflecting broader geopolitical dynamics.

— via World Pulse Now AI Editorial System