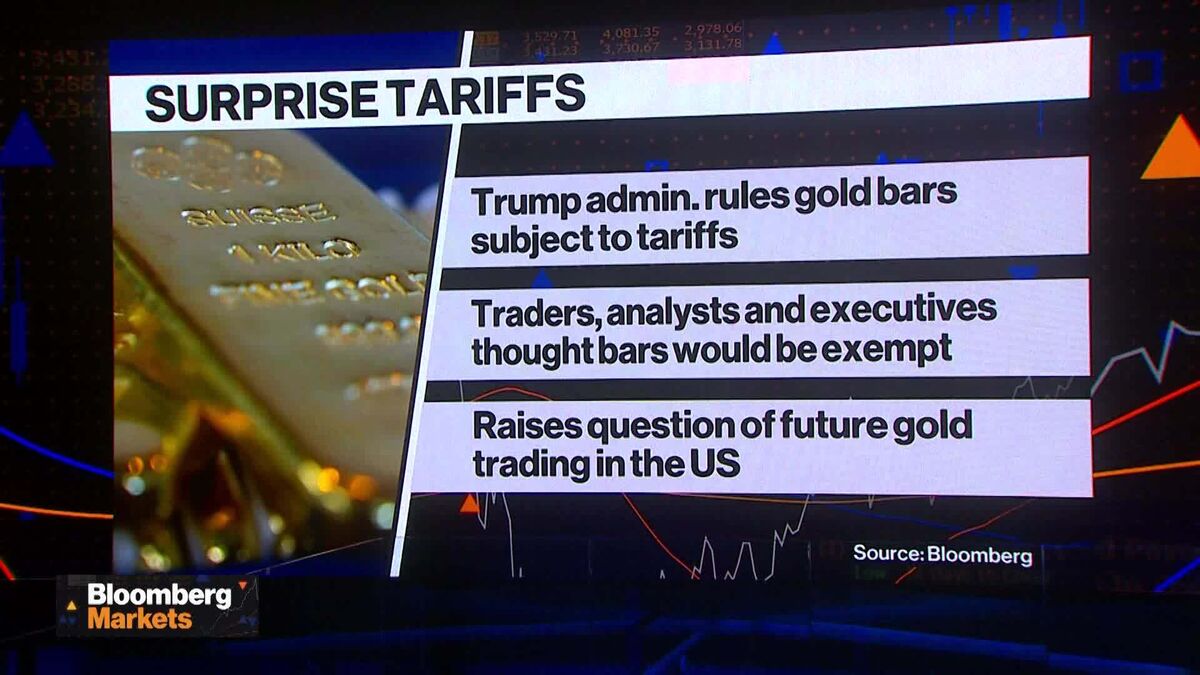

US imposes tariffs on one-kilo gold bars, impacting Switzerland

The US has unexpectedly imposed tariffs on one-kilogram gold bars, disrupting the global bullion market and straining trade relations with Switzerland, a major gold exporter.

Why World Pulse Now?

Global Coverage

All major sources, one page

Emotional Lens

Feel the mood behind headlines

Trending Stories

Know what’s trending, globally

Read Less, Know More

Get summaries. Save time

Multi-Language

Switch languages to read your way

Save for Later

Your stories, stored for later

Live Stats

8,214

126

191

6 hours ago

1-Minute Daily Briefing

Stay sharp in 60 seconds. Get concise summaries of today’s biggest stories — markets, tech, sports, and more

Why World Pulse Now?

Global Coverage

All major sources, one page

Emotional Lens

Feel the mood behind headlines

Trending Stories

Know what’s trending, globally

Read Less, Know More

Get summaries. Save time

Multi-Language

Switch languages to read your way

Save for Later

Your stories, stored for later

Live Stats

8,214

126

191

6 hours ago

1-Minute Daily Briefing

Stay sharp in 60 seconds. Get concise summaries of today’s biggest stories — markets, tech, sports, and more