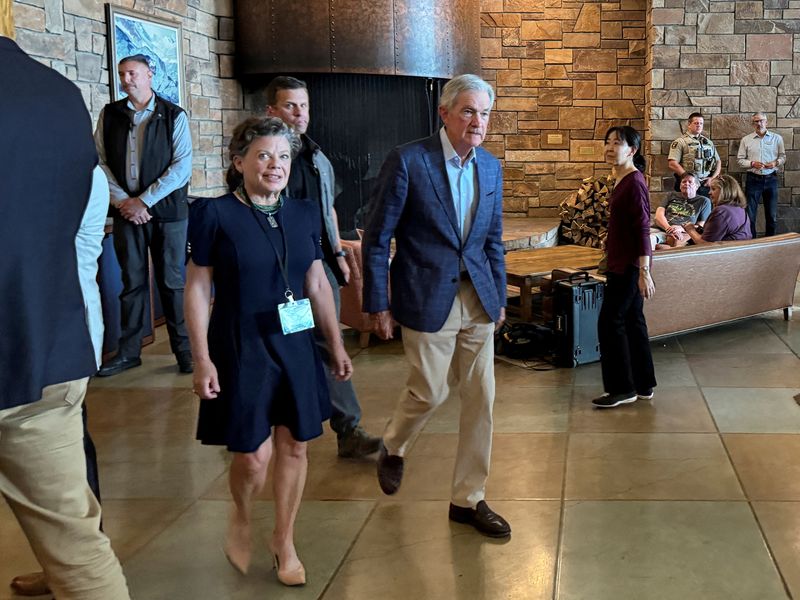

Dollar Declines as Powell Hints at September Rate Cut

The dollar has weakened following Federal Reserve Chair Jerome Powell's suggestion of a possible interest rate cut in September. This announcement has led to a surge in Wall Street, with stocks rising over 1% and increased investor confidence, as the move aims to support economic growth amid uncertainties.

Why World Pulse Now?

Global Coverage

All major sources, one page

Emotional Lens

Feel the mood behind headlines

Trending Stories

Know what’s trending, globally

Read Less, Know More

Get summaries. Save time

Multi-Language

Switch languages to read your way

Save for Later

Your stories, stored for later

Live Stats

6,434

278

200

24 minutes ago

1-Minute Daily Briefing

Stay sharp in 60 seconds. Get concise summaries of today’s biggest stories — markets, tech, sports, and more

Why World Pulse Now?

Global Coverage

All major sources, one page

Emotional Lens

Feel the mood behind headlines

Trending Stories

Know what’s trending, globally

Read Less, Know More

Get summaries. Save time

Multi-Language

Switch languages to read your way

Save for Later

Your stories, stored for later

Live Stats

6,434

278

200

24 minutes ago

1-Minute Daily Briefing

Stay sharp in 60 seconds. Get concise summaries of today’s biggest stories — markets, tech, sports, and more