Lone Star Funds Acquires Hillenbrand for $3.8 Billion

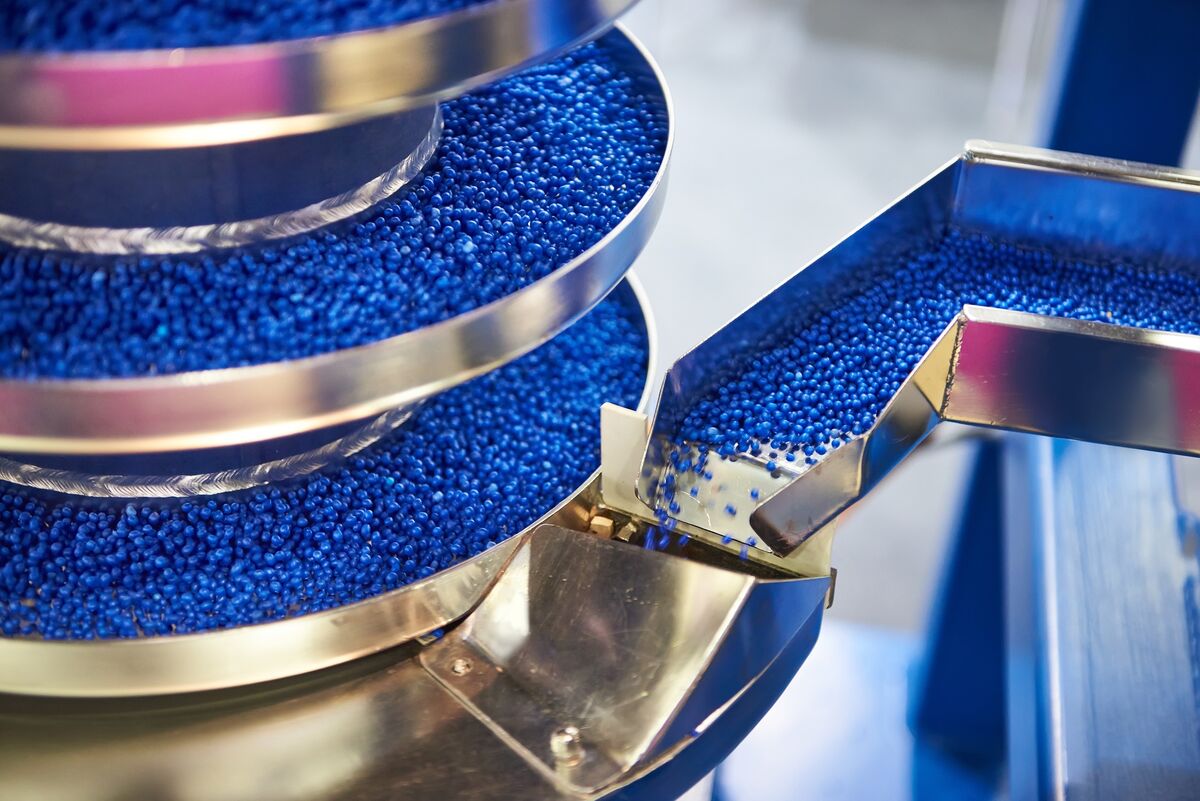

Lone Star Funds has finalized its acquisition of Hillenbrand for approximately $3.8 billion, a strategic move in the private equity sector. This deal is expected to enhance Hillenbrand's operational capabilities and growth potential, providing new opportunities for innovation in the manufacturing industry. The acquisition reflects ongoing interest in the sector and aims to drive competitiveness for both companies.

Lone Star Funds Acquires Hillenbrand for $3.8 Billion

Lone Star Funds has finalized its acquisition of Hillenbrand for approximately $3.8 billion, a strategic move in the private equity sector. This deal is expected to enhance Hillenbrand's operational capabilities and growth potential, providing new opportunities for innovation in the manufacturing industry. The acquisition reflects ongoing interest in the sector and aims to drive competitiveness for both companies.

Why World Pulse Now

Global Coverage

All major sources, one page

Emotional Lens

Feel the mood behind headlines

Trending Stories

Know what’s trending, globally

Read Less, Know More

Get summaries. Save time

Multi-Language

Switch languages to read your way

Save for Later

Your stories, stored for later

Live Stats

Our system has analyzed 5,191 articles worldwide

~216 per hour

598 trending stories shaping headlines

From breaking news to viral moments

Monitoring 198 trusted sources

Major outlets & specialized publications

Latest update an hour ago

Always fresh