Euroclear warns EU that Russian frozen asset plan could lead to higher borrowing costs

NegativeWorld Affairs

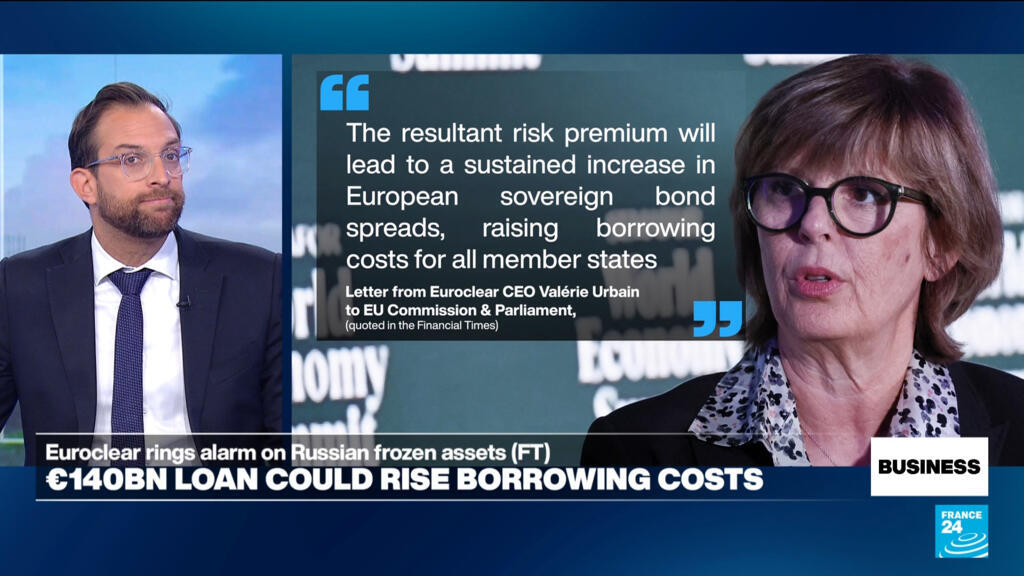

- Euroclear has issued a warning to the European Union regarding its plan to utilize frozen Russian state assets as collateral for €140 billion in loans to Ukraine, suggesting this could result in increased borrowing costs for EU member states. The warning highlights the financial implications of the bloc's strategy amidst ongoing geopolitical tensions.

- This development is significant for Euroclear, as it underscores the complexities involved in managing frozen assets and the potential economic repercussions for the EU. The firm’s caution reflects concerns over the financial stability of member states amid rising costs.

- The situation is emblematic of the broader financial challenges facing the EU, particularly in light of the urgent need for funding to support Ukraine amidst its ongoing conflict with Russia. Additionally, the EU's recent proposals to enhance military mobility and defense capabilities indicate a multifaceted approach to addressing security concerns, further complicating the financial landscape.

— via World Pulse Now AI Editorial System