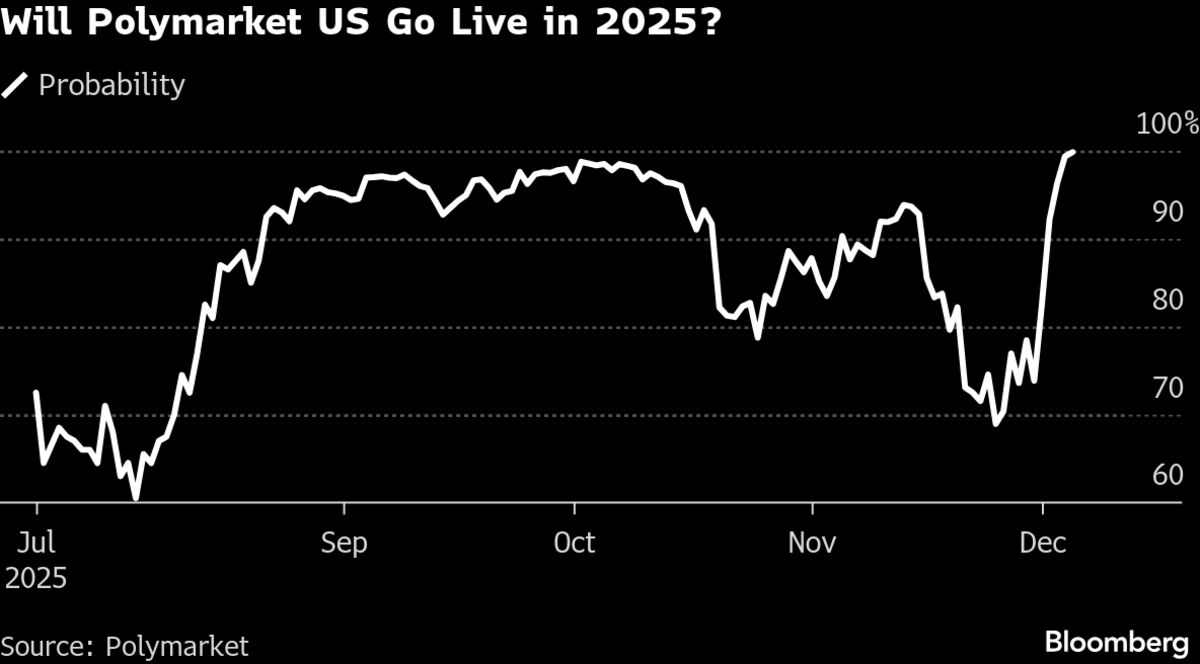

Polymarket Is Struggling With a $59 Million Bet About Itself

NegativeArtificial Intelligence

- Polymarket is facing challenges as traders have placed over $59 million in bets on whether the company will launch its US platform by year-end. This situation highlights the inherent uncertainties in prediction markets, which are designed to resolve ambiguity but are now grappling with it themselves.

- The outcome of this bet is crucial for Polymarket, as it not only reflects investor confidence but also impacts the company's reputation and operational viability in a competitive market. A failure to launch could undermine trust in its platform.

- This scenario underscores broader concerns in the technology sector, particularly regarding the sustainability of investments in emerging markets like prediction platforms and artificial intelligence. As fears of market bubbles grow, the volatility seen in Polymarket's situation may resonate with similar anxieties surrounding other tech investments.

— via World Pulse Now AI Editorial System