A look at the efforts to open private markets, where shares of startups like OpenAI trade, to small investors, and the opportunities and risks they bring (Corrie Driebusch/Wall Street Journal)

NeutralArtificial Intelligence

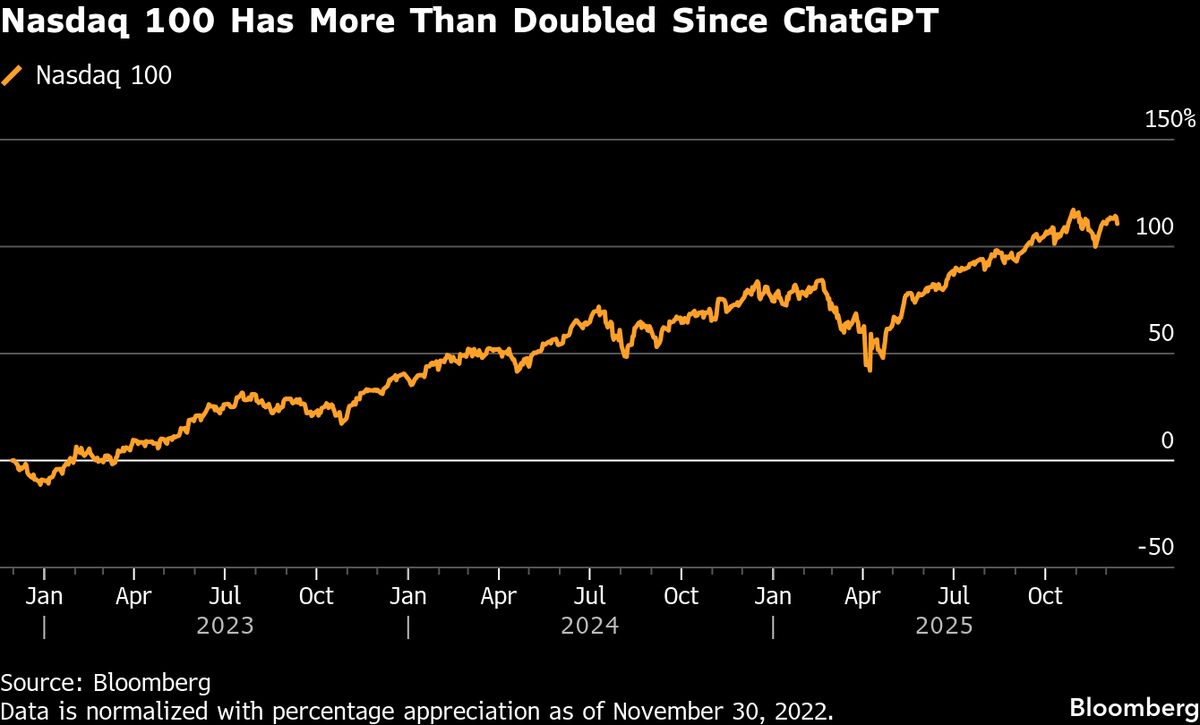

- Efforts are underway to open private markets, allowing small investors to trade shares of high-profile startups like OpenAI. This shift comes as the number of publicly available stocks continues to decline, limiting investment opportunities for the average investor. The movement aims to democratize access to shares that were previously reserved for a select group of wealthy investors.

- For OpenAI, this development represents both an opportunity and a risk. As the company navigates its position in the evolving market landscape, it could attract a broader base of investors, potentially increasing its valuation and market presence. However, it also faces scrutiny regarding its financial strategies and long-term sustainability amid rising competition.

- The broader implications of this trend reflect ongoing debates about the accessibility of investment opportunities and the financial health of private companies. As firms like SpaceX and Anthropic prepare for significant financial maneuvers, the landscape of private equity is rapidly changing, raising questions about the economic viability of startups and the risks associated with investing in emerging technologies.

— via World Pulse Now AI Editorial System