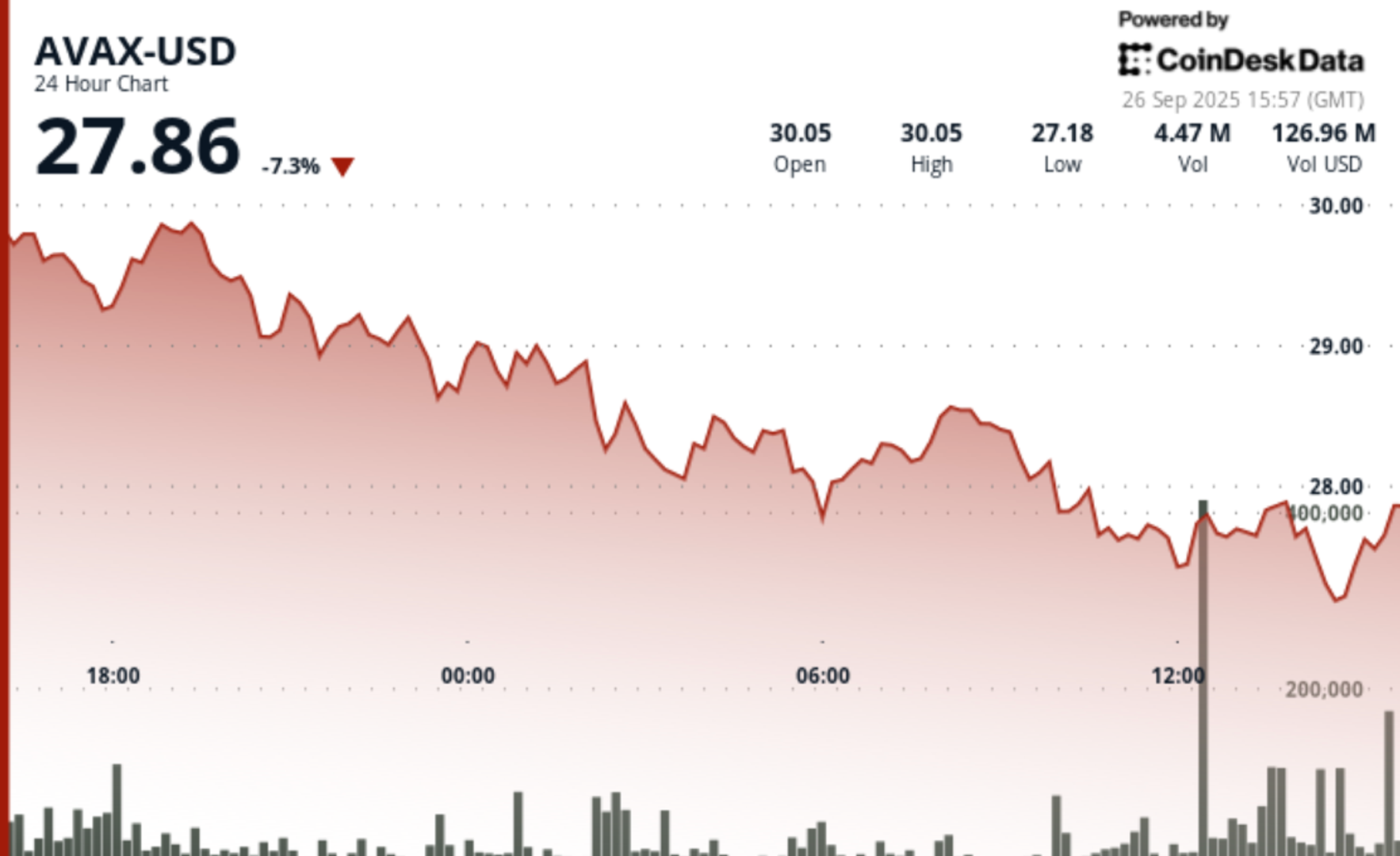

Avalanche's AVAX Extends Weekly Losses to 18% as Institutional Backing Fails to Lift Market

NegativeCryptocurrency

Avalanche's AVAX has seen a significant decline, extending its weekly losses to 18%. Despite hopes that institutional backing would provide a boost to the market, it appears that these efforts have not been enough to stabilize prices. This situation is concerning for investors and highlights the ongoing volatility in the cryptocurrency sector, raising questions about the future of digital assets.

— Curated by the World Pulse Now AI Editorial System