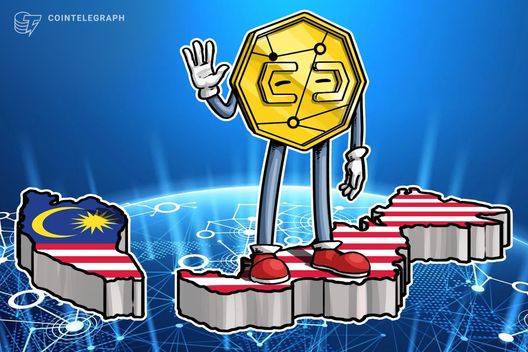

Malaysia’s central bank sets three-year roadmap to pilot asset tokenization

PositiveCryptocurrency

Malaysia's central bank, Bank Negara Malaysia (BNM), has unveiled an exciting three-year roadmap to pilot asset tokenization. This initiative is set to enhance real-world applications, focusing on areas like SME supply chain financing, Shariah-compliant Islamic products, green finance, and facilitating 24/7 cross-border payments. This move is significant as it positions Malaysia at the forefront of financial innovation, potentially boosting economic growth and attracting investment.

— Curated by the World Pulse Now AI Editorial System