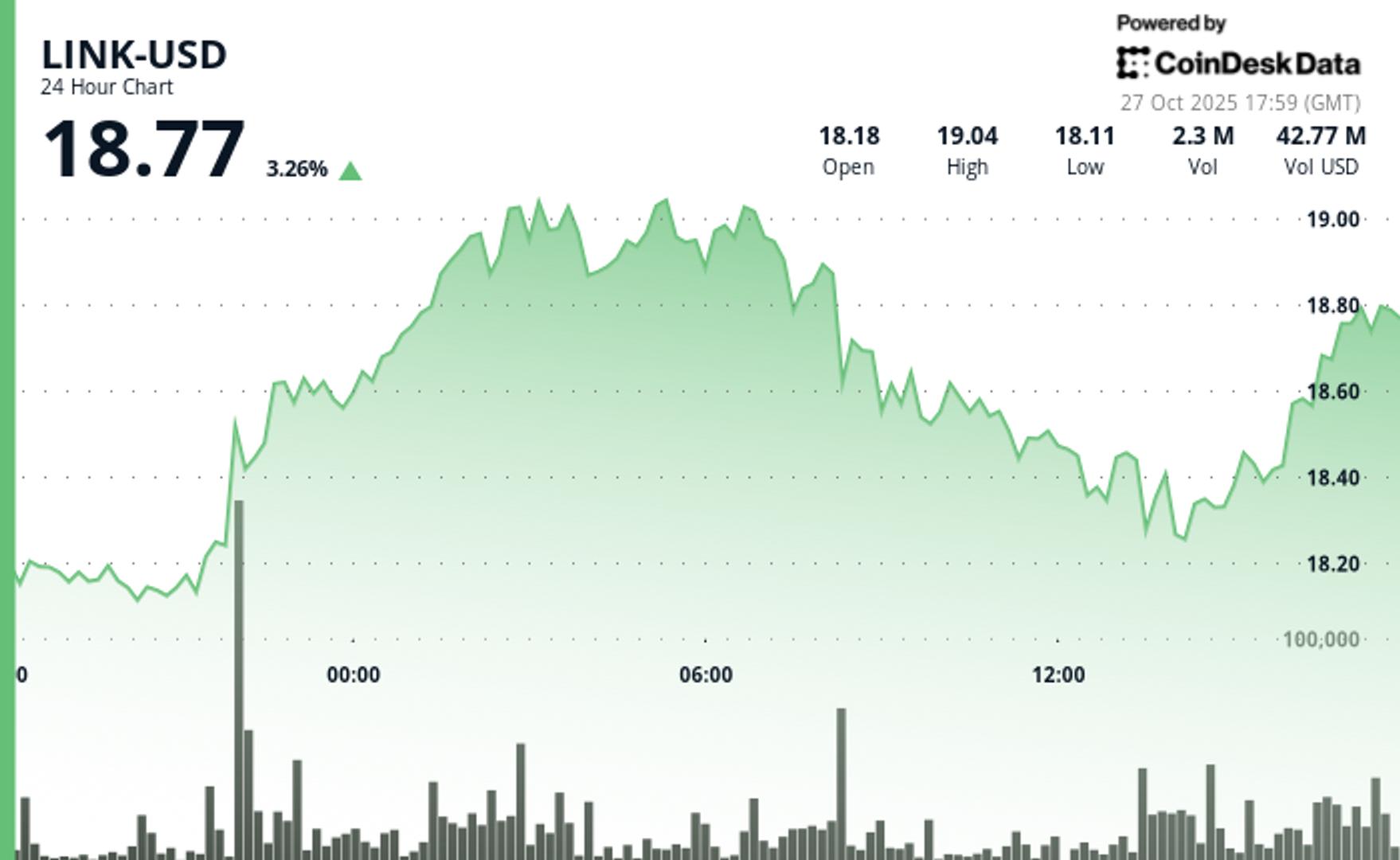

Bitcoin Profitability On The Rise — More Coins Back In The Green As Market Recovers

PositiveCryptocurrency

Bitcoin's price has rebounded above $113,000, signaling a recovery in the cryptocurrency market after a recent downturn. This resurgence is significant as it not only restores confidence among investors but also allows many to start seeing substantial profits from their investments. The positive trend indicates a potential shift in market dynamics, making it an exciting time for both seasoned and new investors.

— Curated by the World Pulse Now AI Editorial System