Chainlink Bulls Eye $30 Target But Must First Overcome Crucial Resistance

PositiveCryptocurrency

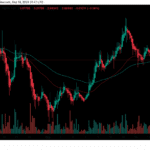

Prominent market analyst Ali Martinez has shared optimistic insights about Chainlink's potential to reach the $30 mark, despite recent volatility that saw prices drop nearly 5%. This analysis highlights the importance of overcoming the crucial $25 resistance level, which could pave the way for a significant upward movement. As investors keep a close eye on these developments, understanding the dynamics of Chainlink's price action is essential for making informed decisions in the cryptocurrency market.

— Curated by the World Pulse Now AI Editorial System