LINK vs XRP: Which Crypto is Better to Hold in Q4 2025?

NeutralCryptocurrency

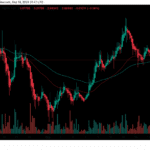

As we approach Q4 2025, XRP and Chainlink are navigating distinct market conditions. XRP has been in the spotlight due to a surge in ETF approvals and a new tokenization deal, while Chainlink is notable for its resilience in the derivatives market, showing less selling pressure compared to its peers. This comparison is crucial for investors looking to make informed decisions about which cryptocurrency might be a better hold in the coming months.

— Curated by the World Pulse Now AI Editorial System