Powell Speech Today: Bitcoin Braces for Volatility as Fed Signals Divide

NeutralCryptocurrency

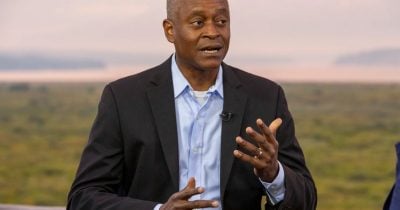

Jerome Powell's upcoming speech at the Greater Providence Chamber of Commerce is set to be a key moment for the markets, especially for Bitcoin, as it follows the Federal Reserve's recent rate cut. Scheduled for 12:35 p.m. ET, this speech could influence market volatility and investor sentiment, making it a significant event for those tracking economic trends and cryptocurrency movements.

— Curated by the World Pulse Now AI Editorial System