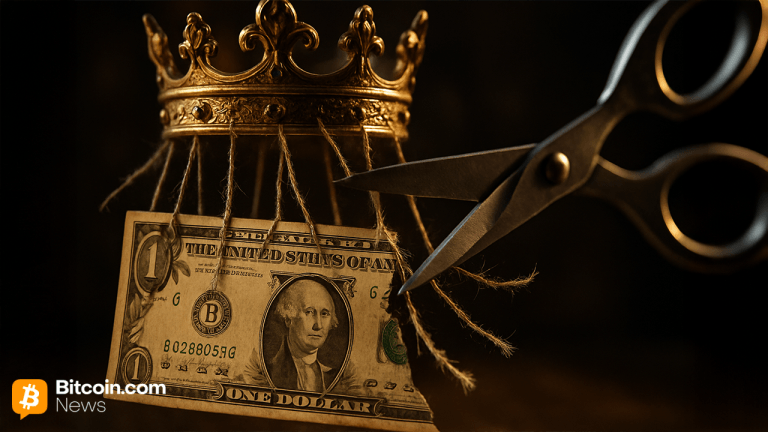

Gold Hits $3,700 as Sprott’s Wong Says Dollar’s Store-of-Value Crown May Slip

PositiveCryptocurrency

Gold prices have surged to $3,700, with expert Eric Wong from Sprott suggesting that the dollar's status as a store of value may be at risk. This rise in gold's value is significant as it reflects growing concerns about the dollar's stability and could lead to increased interest in gold as a safe investment. Investors are paying close attention to these developments, as they may influence market trends and economic strategies moving forward.

— Curated by the World Pulse Now AI Editorial System