Bitwise Targets Wall Street With Stablecoin And Tokenization ETF Filing

PositiveCryptocurrency

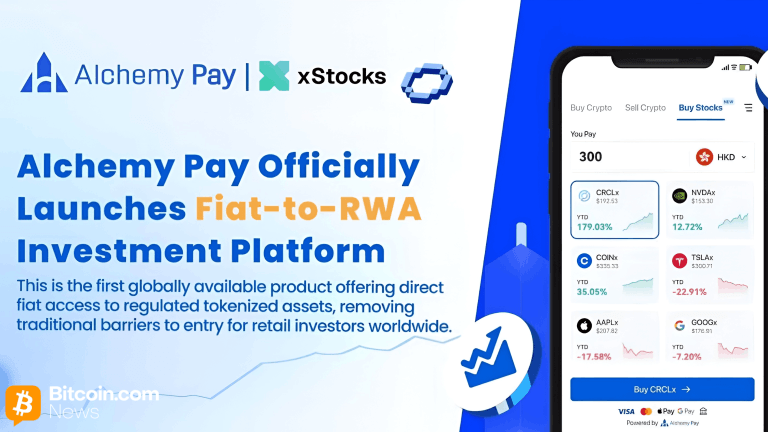

Bitwise Asset Management is making waves on Wall Street by filing for a new fund that combines stocks with crypto assets linked to stablecoins and tokenization. This move is significant as it could pave the way for innovative investment opportunities in the U.S. market, especially as the demand for crypto-related financial products continues to grow. If approved, this fund could be one of the first of its kind, reflecting a shift in how traditional finance is integrating with digital assets.

— Curated by the World Pulse Now AI Editorial System