Gemini AI’s Dogecoin Price Prediction — Why Maxi Doge Could Be the Next Top Meme Coin

NeutralCryptocurrency

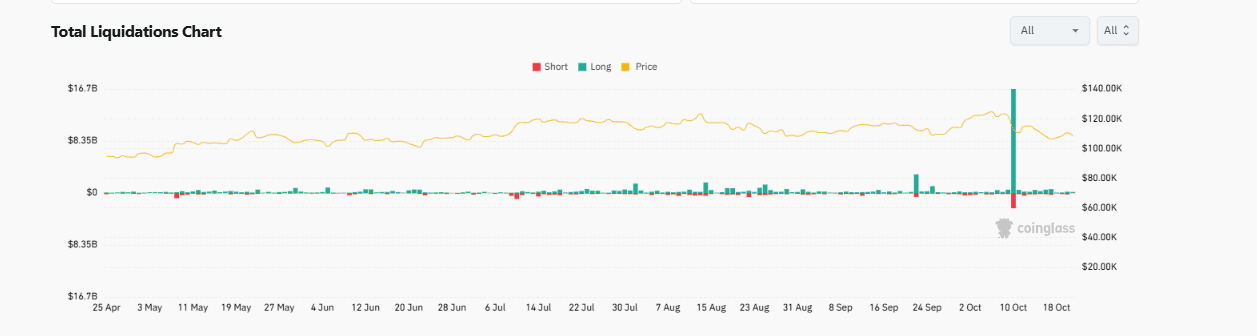

Gemini AI has provided insights into the future of Dogecoin amidst recent market fluctuations caused by US President Donald Trump's tariff threats on China. As Dogecoin struggles, the emergence of Maxi Doge, a new dog-themed token, raises questions about its potential as the next top meme coin. This analysis is crucial for investors looking to navigate the volatile cryptocurrency landscape and identify promising opportunities.

— Curated by the World Pulse Now AI Editorial System