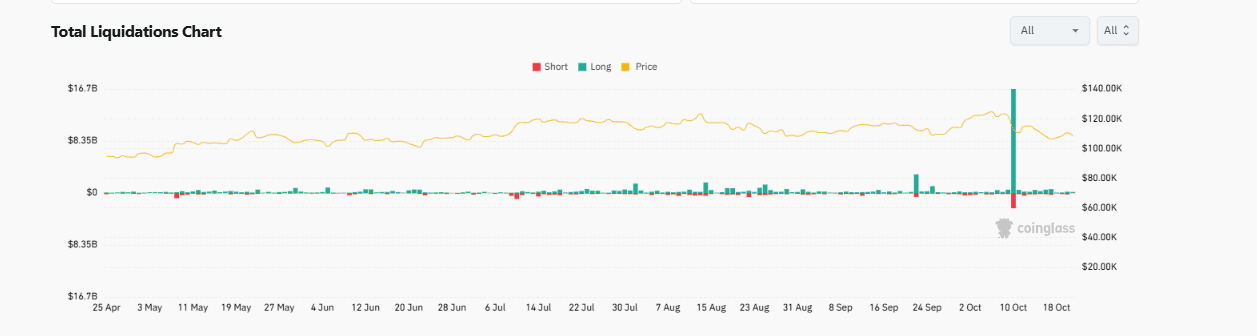

After the October 10 Crypto Flash Crash, Expect A Wave of Lawsuits: Wintermute CEO

NegativeCryptocurrency

The recent crypto flash crash on October 10 has raised concerns about potential lawsuits, as highlighted by Wintermute's CEO. This incident, coinciding with Donald Trump's reaction to China's new tariffs on rare earth metals, underscores the volatility in the crypto market and the ripple effects of geopolitical events. As investors grapple with the aftermath, the implications for regulatory scrutiny and market stability are significant, making this a crucial moment for the industry.

— Curated by the World Pulse Now AI Editorial System