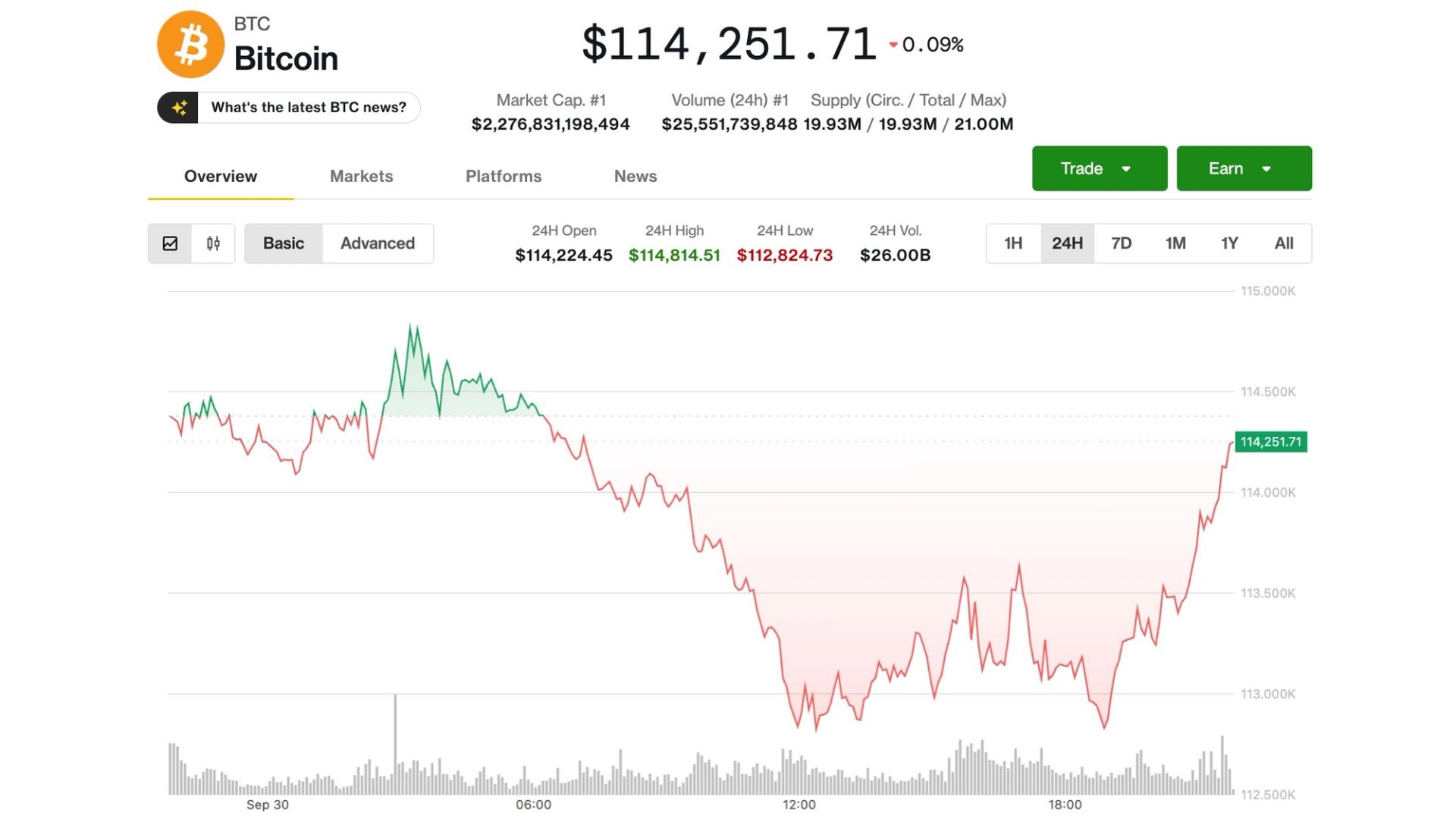

Bitcoin Steady, but Bitfinex Warns of Downside Risks as U.S. Government Shutdown Looms

NeutralCryptocurrency

Bitcoin remains steady despite a backdrop of declining altcoins like ETH, SOL, and AVAX. Bitfinex has issued a warning about potential downside risks as a U.S. government shutdown approaches. This situation is significant as it highlights the volatility in the cryptocurrency market and the impact of external economic factors on digital assets.

— Curated by the World Pulse Now AI Editorial System