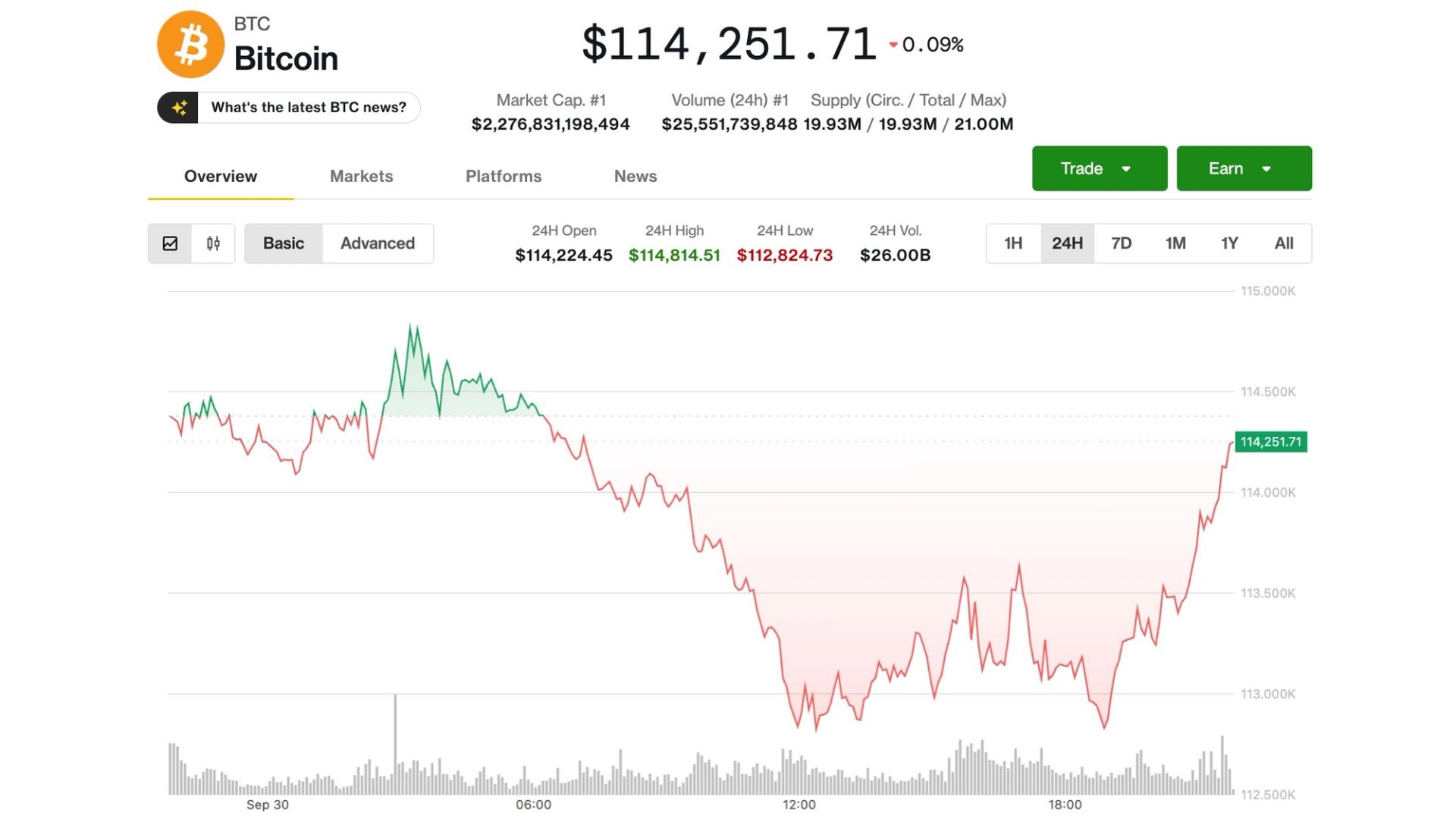

Pro Bitcoin traders' view on BTC’s flash crash to $112.6K: Did anything change?

PositiveCryptocurrency

Pro Bitcoin traders are analyzing the recent flash crash of BTC to $112.6K, noting that despite the volatility, there are signs of bullish sentiment in the market. Increased ETF inflows and corporate accumulation suggest that investors remain optimistic about Bitcoin's future, even as macroeconomic data raises concerns. This perspective is crucial as it highlights the resilience of Bitcoin amidst market fluctuations and could influence trading strategies moving forward.

— Curated by the World Pulse Now AI Editorial System