Bitcoin Options Traders Position for December With Heavy $120K and $140K Strikes

NeutralCryptocurrency

Bitcoin Options Traders Position for December With Heavy $120K and $140K Strikes

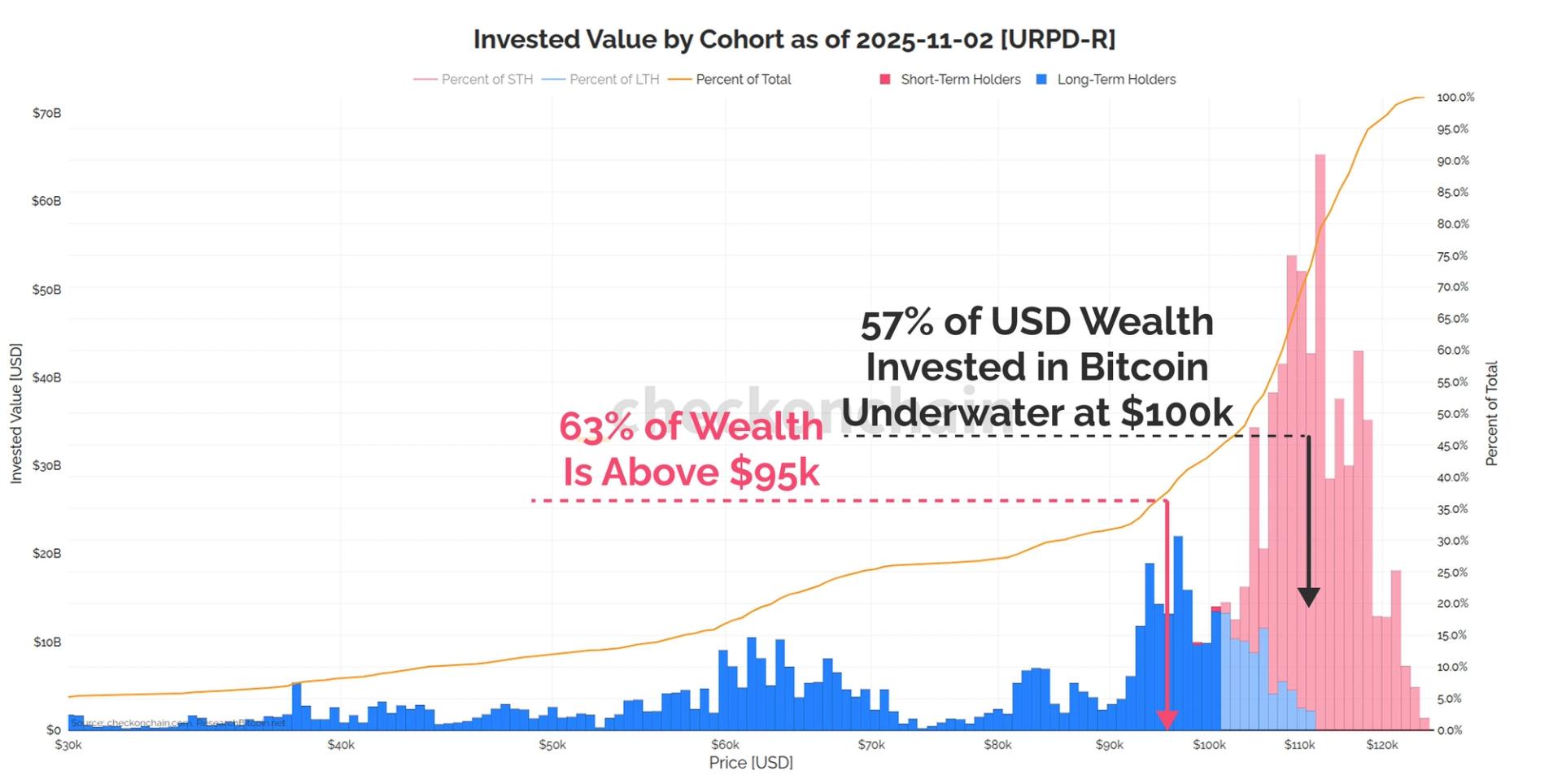

Bitcoin options traders are gearing up for December with significant positions at $120K and $140K strikes. This activity indicates a strong interest in the cryptocurrency market as traders speculate on future price movements. Understanding these positions can provide insights into market sentiment and potential volatility, making it crucial for investors to stay informed.

— via World Pulse Now AI Editorial System