Why Did The Bitcoin Price Crash Below $100,000? The Bear Market Is Here

NegativeCryptocurrency

Why Did The Bitcoin Price Crash Below $100,000? The Bear Market Is Here

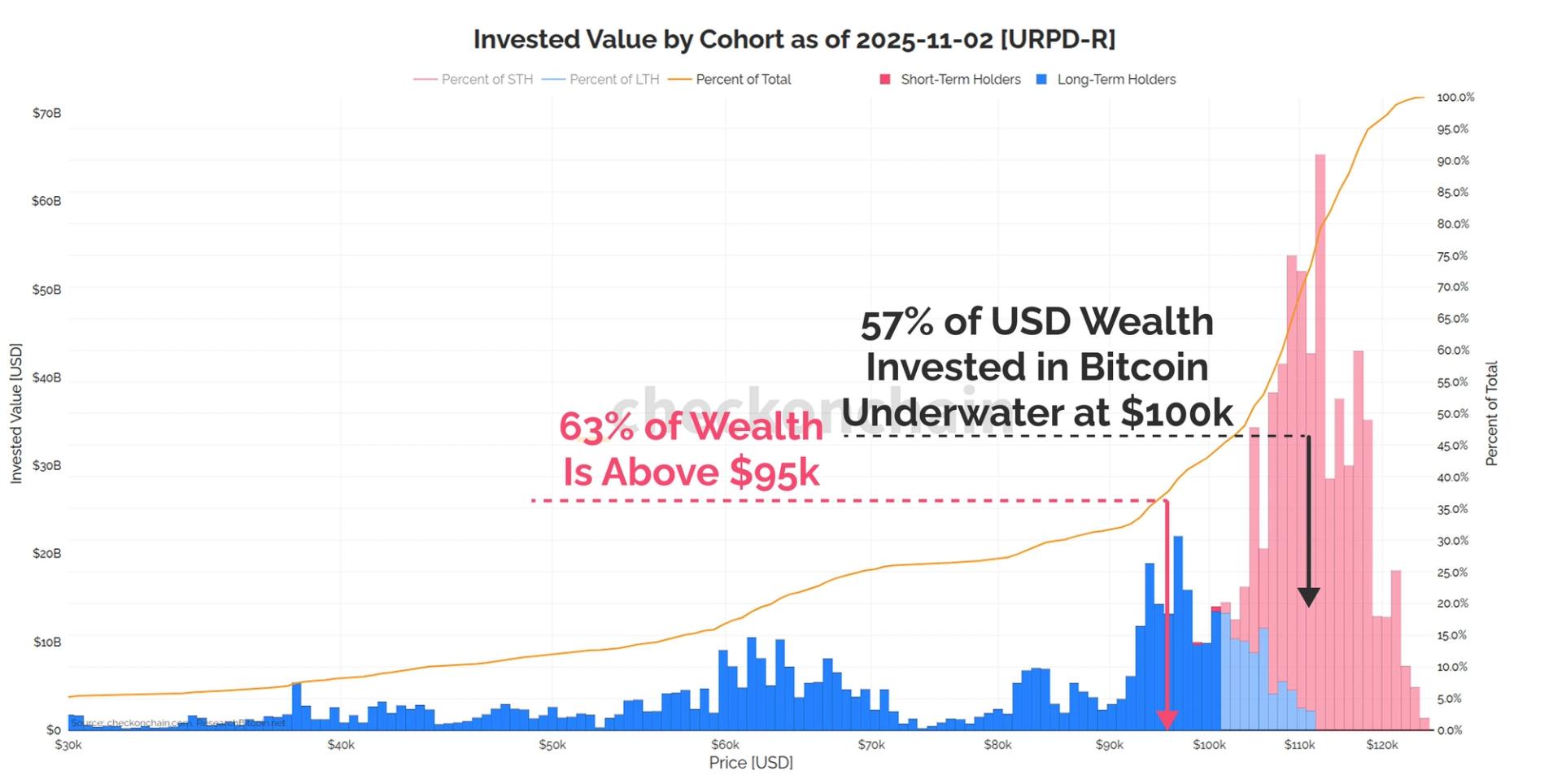

The Bitcoin price has plummeted below $100,000 for the first time in four months, marking a significant downturn in the cryptocurrency market. This drop, which saw nearly 6% wiped off its value in just one day, is largely due to a strengthening US dollar, outflows from Spot Bitcoin ETFs, and substantial liquidations in the crypto futures market. This situation raises concerns among investors about the stability and future of Bitcoin, highlighting the volatility that can impact their investments.

— via World Pulse Now AI Editorial System