Spot XRP ETFs Outpace Market With 12-Day Inflow Streak Nearing $1B Mark

PositiveCryptocurrency

- Spot XRP exchange-traded funds (ETFs) have achieved a remarkable inflow streak, nearing $1 billion over 12 consecutive days, reflecting a significant surge in institutional interest in XRP. This trend highlights the growing acceptance and demand for cryptocurrency investment products in the market.

- The inflow of nearly $1 billion into XRP ETFs underscores the cryptocurrency's increasing appeal among institutional investors, suggesting a potential shift in market dynamics as XRP continues to gain traction in the financial landscape.

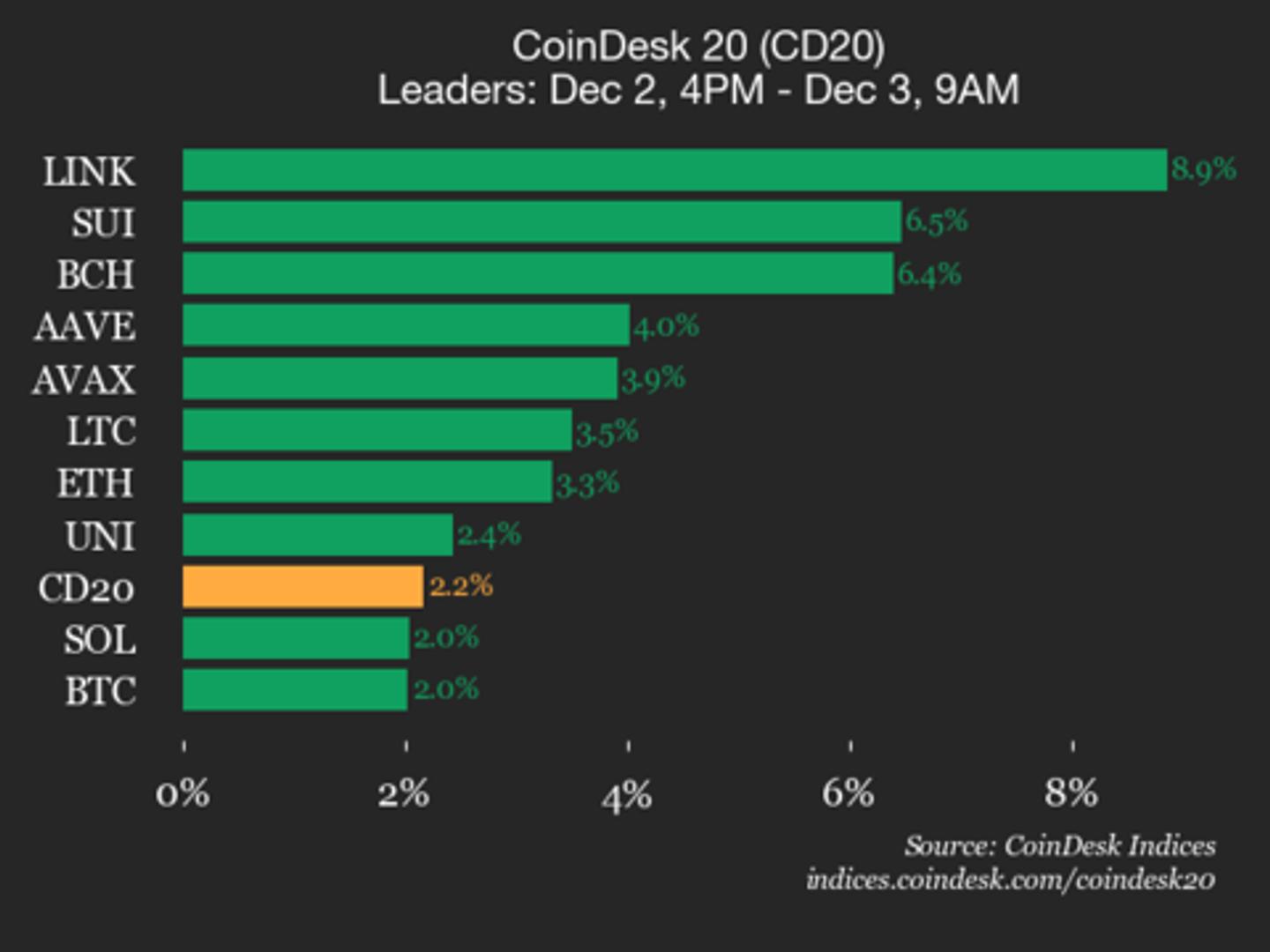

- This development is part of a broader trend where XRP ETFs are outpacing traditional cryptocurrencies like Bitcoin and Ethereum, indicating a potential shift in investor preferences. The strong inflows and the launch of multiple XRP ETFs signal a bullish sentiment in the market, with many analysts suggesting that this could lead to a new bull trend for XRP.

— via World Pulse Now AI Editorial System