Tether-backed Twenty One Capital jolted as Bitcoin slide hits DAT valuations

NegativeCryptocurrency

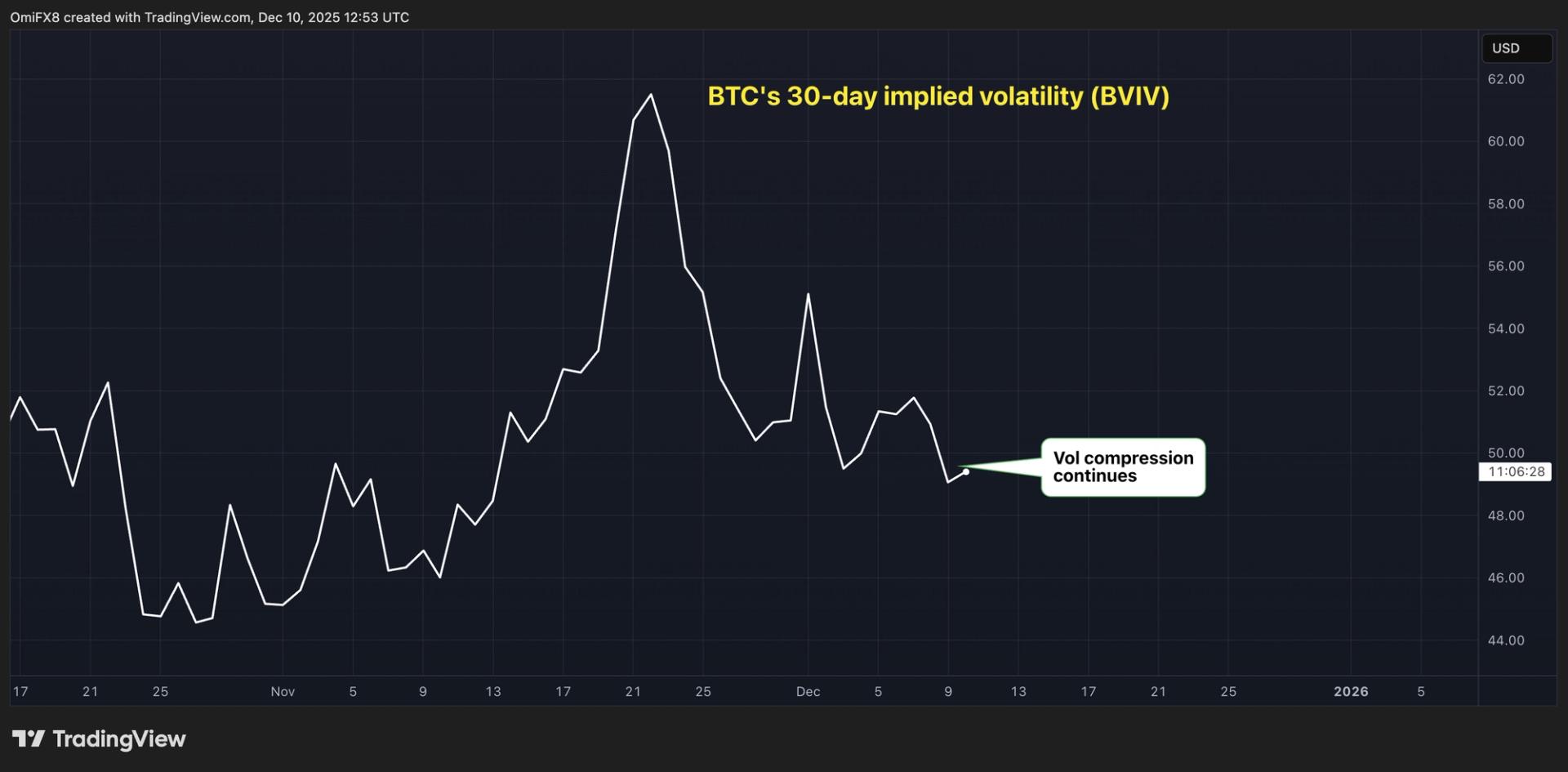

- Tether-backed Twenty One Capital faced significant market turbulence as Bitcoin's value declined, impacting the valuations of Digital Asset Trust (DAT) and compressing mNAV premiums. The firm, which recently went public via SPAC, is now under pressure to demonstrate its value beyond merely holding Bitcoin.

- This development is critical for Twenty One Capital as it seeks to establish credibility in the cryptocurrency market amidst fears of a potential sell-off, particularly after transferring 43,500 BTC into escrow ahead of its public debut.

- The situation reflects broader challenges in the cryptocurrency sector, where firms are grappling with collapsing equity premiums and a shift towards more conservative strategies, indicating a potential shift in investor sentiment and market dynamics.

— via World Pulse Now AI Editorial System