Here’s Why Strategy’s $1 Billion Bitcoin Purchase Did Not Trigger A Price Rally

NeutralCryptocurrency

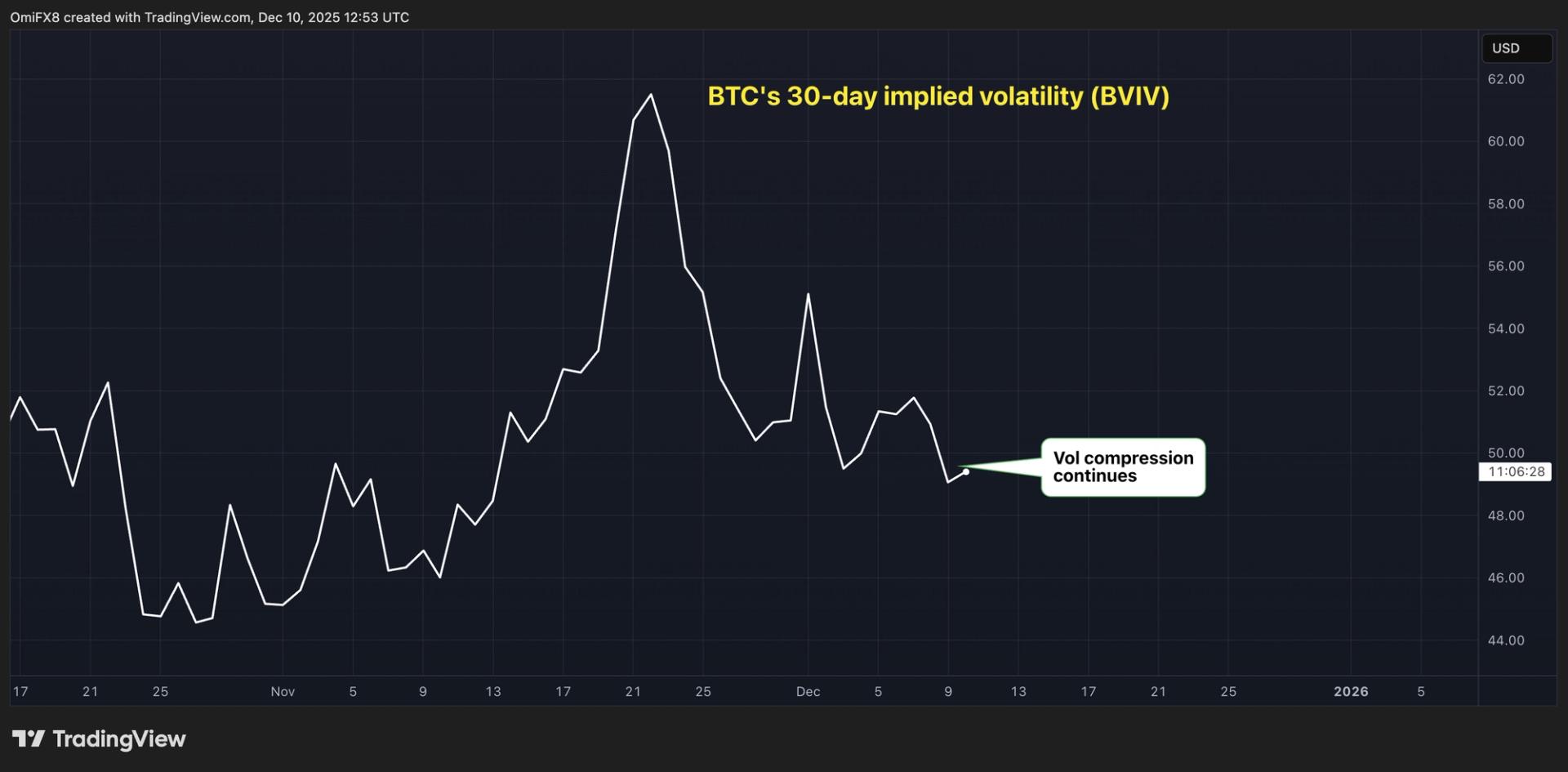

- Strategy's recent acquisition of over 10,000 Bitcoin for $1 billion did not lead to an expected price rally, as market analysts noted that the transaction's execution through over-the-counter (OTC) desks kept price movements stable. Quinten Francois explained that such large purchases do not impact real-time order books, resulting in minimal visible price changes.

- This development is significant for Strategy, as it reflects the company's ongoing commitment to Bitcoin despite a notable reduction in its purchasing activity earlier in 2025. The acquisition increases its total holdings to approximately 660,624 BTC, valued at around $49.35 billion, showcasing a strategic approach amid fluctuating market conditions.

- The muted market reaction to Strategy's large buy highlights ongoing discussions about Bitcoin's liquidity and institutional investment strategies. Analysts are observing how such significant purchases influence market dynamics, especially as concerns about potential sell-offs arise. The contrasting views on Bitcoin's long-term viability and the company's financial health further complicate the narrative surrounding institutional investments in cryptocurrency.

— via World Pulse Now AI Editorial System