Nunchuk: The Open-Source Mobile Multi-Sig Wallet Now Securing Over $1 Billion in Bitcoin

PositiveCryptocurrency

- Nunchuk, an open-source mobile multi-signature wallet, has secured over $1 billion in Bitcoin, establishing itself as a leading self-custody tool for advanced Bitcoin users, particularly after navigating regulatory challenges in Canada and innovating in Bitcoin inheritance solutions.

- This significant milestone underscores Nunchuk's growing importance in the cryptocurrency landscape, as it provides users with enhanced security and control over their Bitcoin holdings, catering to a demographic that values self-custody and privacy.

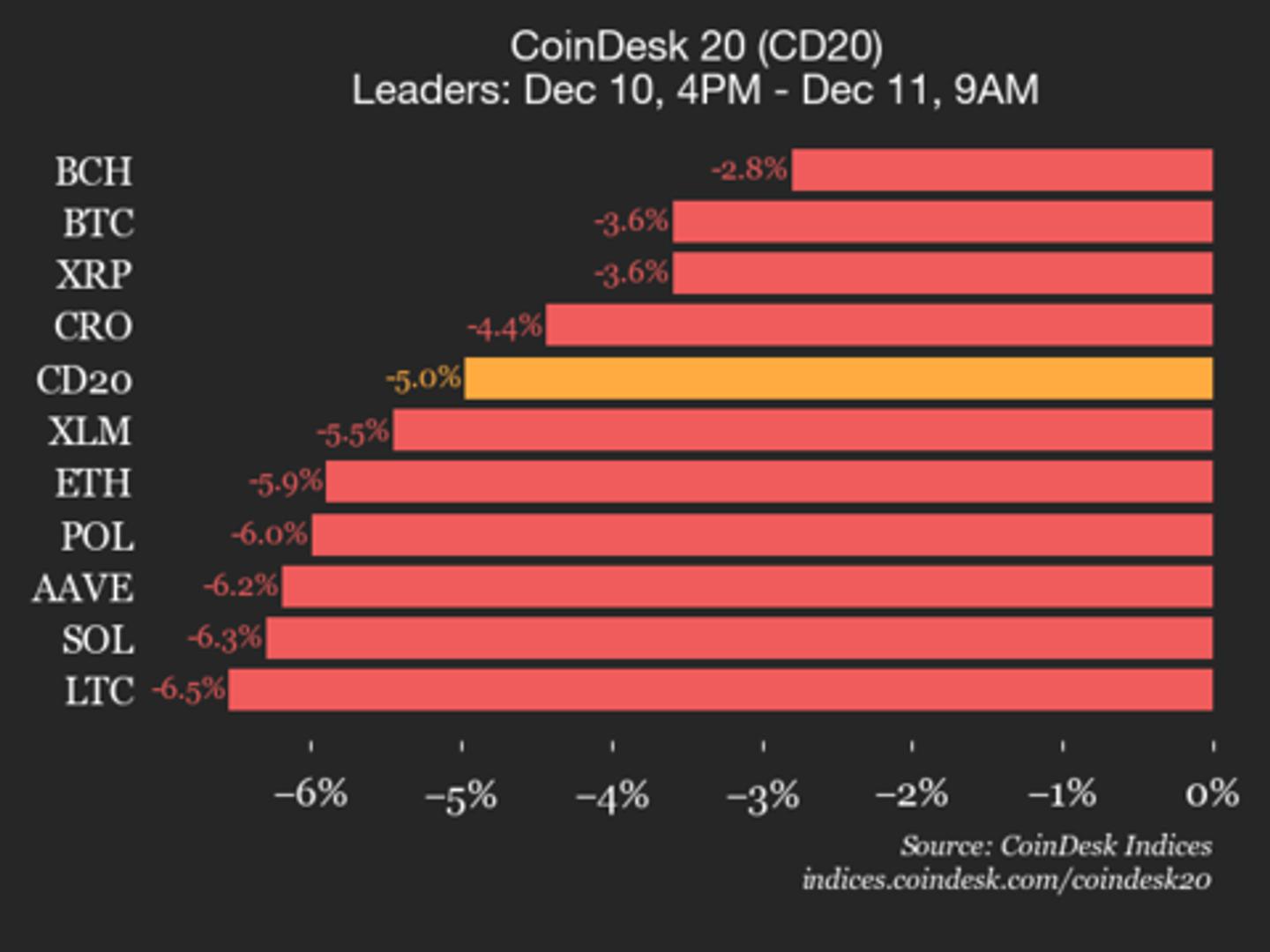

- The broader cryptocurrency market is currently experiencing volatility, with Bitcoin's price fluctuating significantly, yet Nunchuk's success highlights a trend towards decentralized finance solutions amidst regulatory developments and shifting investor sentiments.

— via World Pulse Now AI Editorial System