Plasma TVL Erupts After Mainnet: XPL Price Prediction For October?

PositiveCryptocurrency

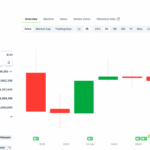

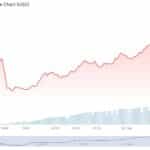

The launch of Plasma's mainnet has sparked a surge in total value locked (TVL), indicating strong market interest and liquidity for its native token, XPL. This development is significant as it not only enhances the trading environment for XPL but also showcases the potential of Plasma as a robust Layer 1 blockchain for stablecoins. With integrations into major DeFi protocols and listings on top exchanges, Plasma is poised to make a substantial impact in the crypto space.

— Curated by the World Pulse Now AI Editorial System