XPL surges 113% to all-time high following launch day crash

PositiveCryptocurrency

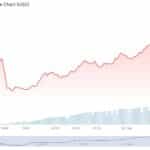

The XPL token from Plasma has made a remarkable comeback, surging 113% to reach an all-time high of $1.54 shortly after a significant drop on its launch day. This recovery is noteworthy as it reflects the resilience of the token despite initial selling pressure from users cashing in on airdrops. The swift rebound highlights investor confidence and the potential for growth in the cryptocurrency market, making it a key event for enthusiasts and investors alike.

— Curated by the World Pulse Now AI Editorial System