FOMC Meeting October 29 2025: What to expect from Fed interest rate decision

NeutralCryptocurrency

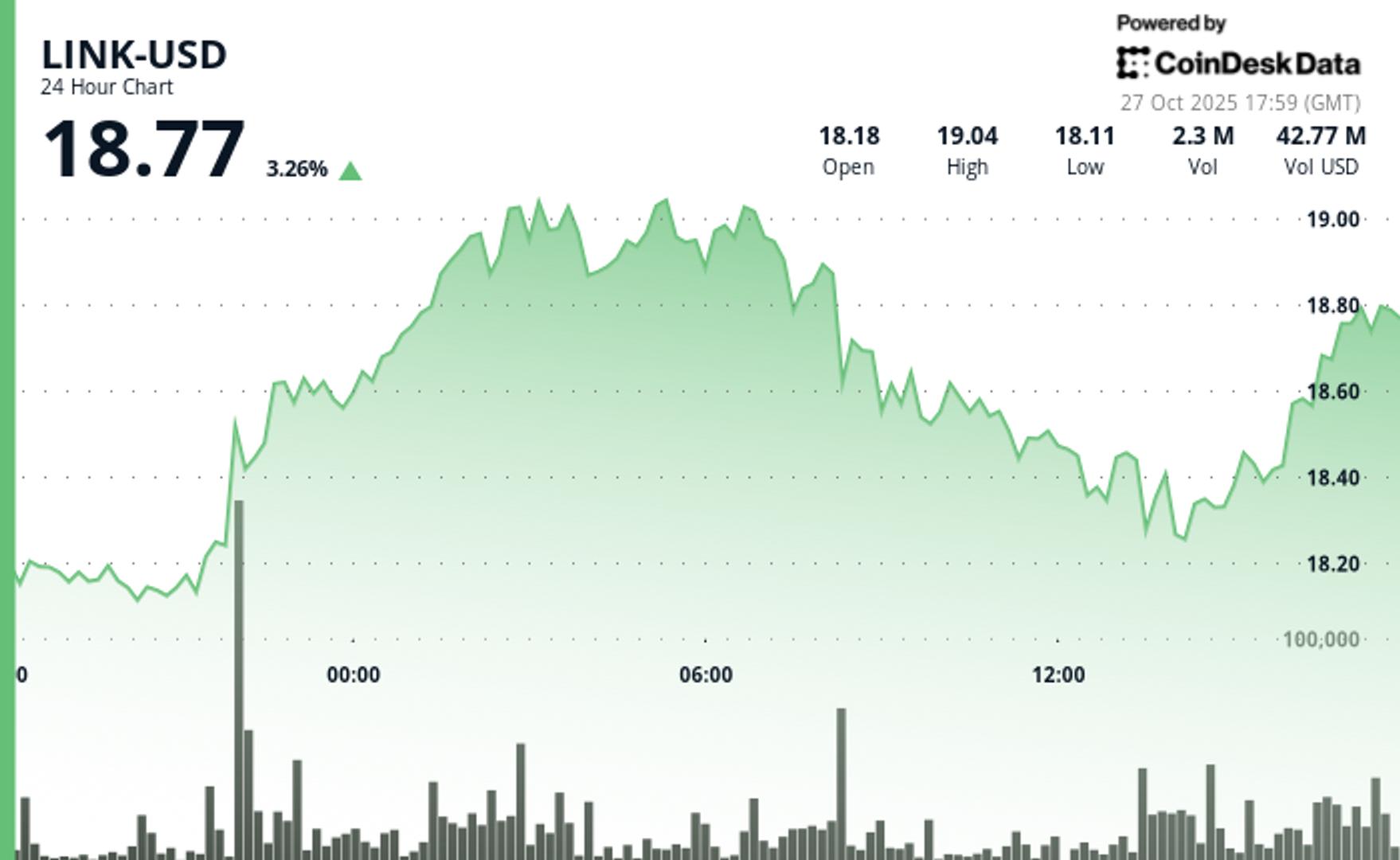

The Federal Open Market Committee (FOMC) is preparing to announce its decision on interest rates, a move that could significantly impact crypto markets. Investors are closely monitoring this meeting, as changes in interest rates can influence market dynamics and investment strategies. Understanding the FOMC's decisions is crucial for anyone involved in finance, especially in the rapidly evolving world of cryptocurrencies.

— Curated by the World Pulse Now AI Editorial System