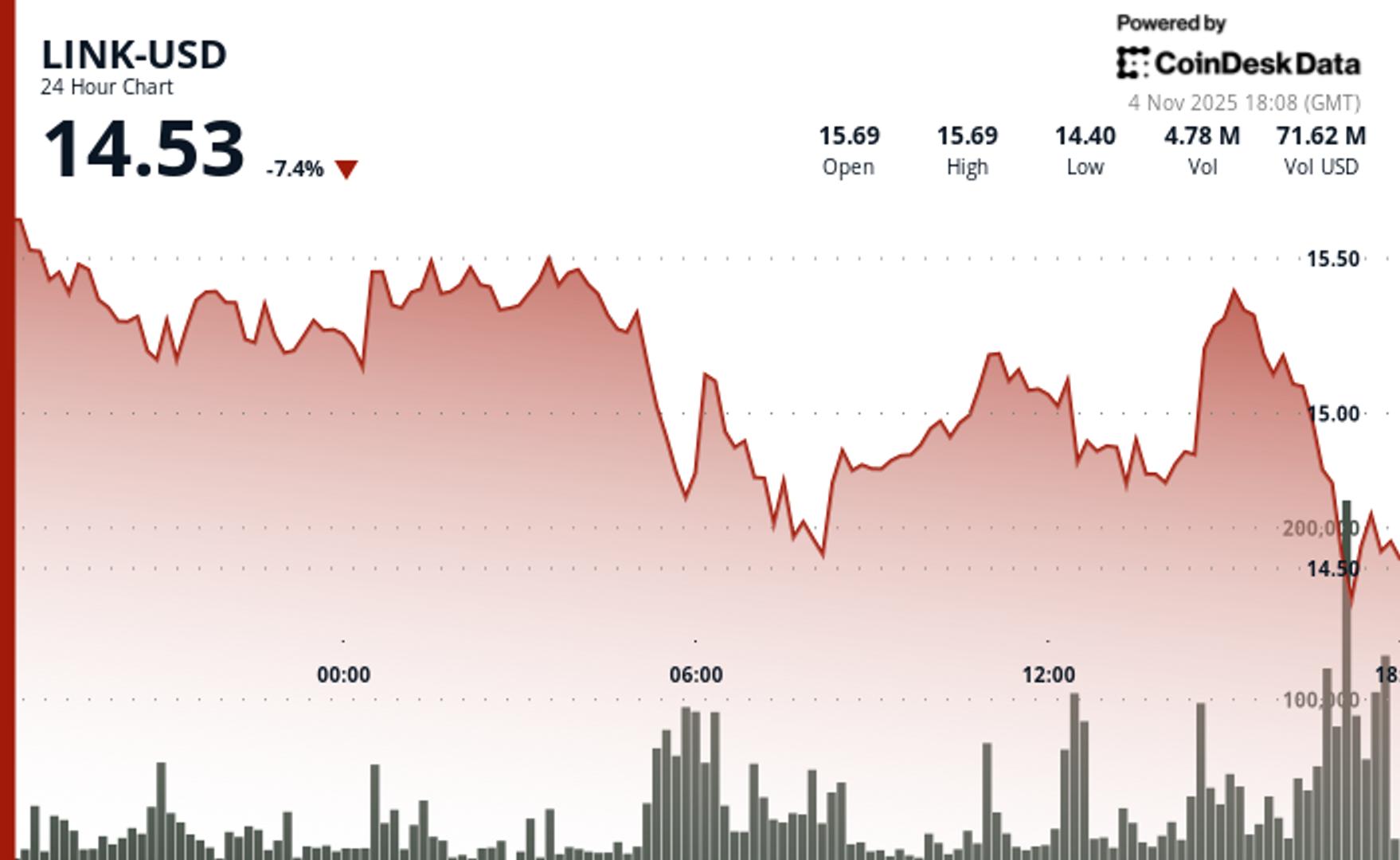

Moonwell Hack: $1M Lost After Chainlink Flaw, WELL Crypto Slumps To 2025 Lows

NegativeCryptocurrency

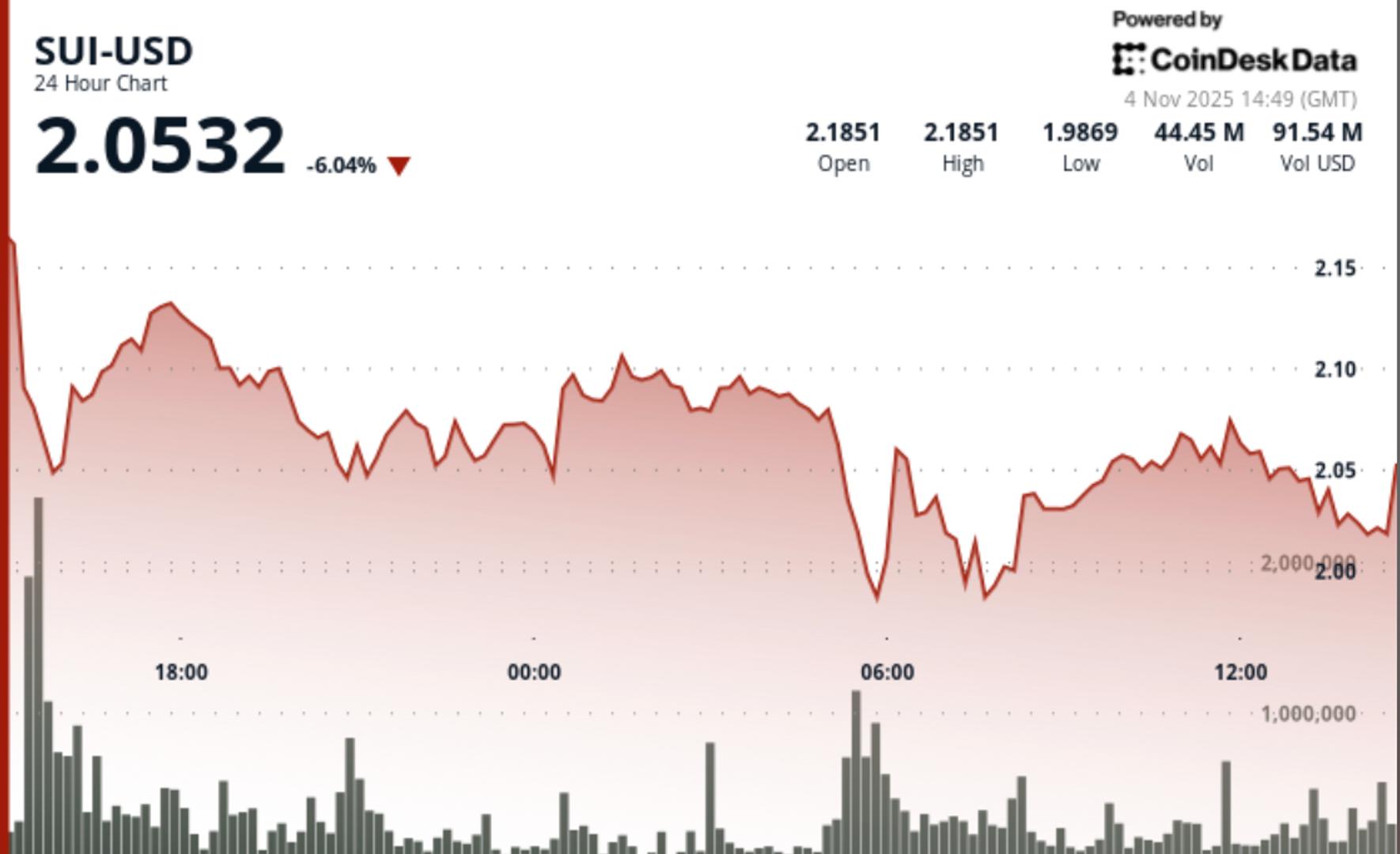

This week, the crypto world faced a setback as Moonwell DeFi lost $1 million due to a flaw in Chainlink, following a significant hack that drained over $128 million from various DeFi protocols. The recent events have left investors cautious, contributing to a slump in crypto prices, including the WELL token, which has hit its lowest point since 2025.

— Curated by the World Pulse Now AI Editorial System